Loading

Get Borrower's Affidavit - The Illinois Housing Development Authority - Ihda

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Borrower’s Affidavit - The Illinois Housing Development Authority - Ihda online

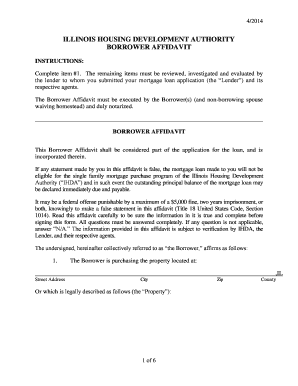

Completing the Borrower’s Affidavit is an essential step in your mortgage application process with the Illinois Housing Development Authority. This guide provides clear instructions to help you fill out the affidavit online effectively and accurately.

Follow the steps to fill out the Borrower’s Affidavit online.

- Press the ‘Get Form’ button to obtain the Borrower’s Affidavit form and open it in your preferred editing tool.

- Begin by completing item #1, which requires the street address, city, zip code, and county of the property you are purchasing.

- In item #2, indicate your intention to occupy the property as your principal residence shortly after the mortgage loan closing.

- For item #3, confirm your current intent not to lease, sell, assign, or transfer any interest in the property.

- In item #4, affirm that you have not entered any agreements to lease, sell, assign, or transfer the property.

- If applicable, for item #5, confirm that you will occupy one unit of the property if it is a two, three, or four-family residence.

- For item #6, ensure that you do not intend to use more than fifteen percent of the property for trade or business.

- In item #7, reaffirm that you do not plan to use the property as an investment property or recreational home.

- Answer item #8 to disclose any present ownership interests you had in a principal residence within the last three years.

- In item #9, provide a true and accurate copy of your agreement with the property seller and any documentation of work done on the property.

- Confirm in item #10 that you have not incurred other debts related to the property acquisition.

- For item #11, verify that the acquisition cost in your agreement with the seller is accurate.

- In item #12, state whether the property is completed or if additional work is necessary.

- Confirm in item #13 that loan proceeds will be used for property acquisition and necessary repairs, not to pay off previous debts.

- In item #14, affirm that no loan proceeds will be used for purchasing non-permanent property items.

- Complete item #15 by stating whether you have provided your last three years of federal income tax returns.

- Agree in item #16 to notify IHDA if you vacate the property and keep them informed of your mailing address.

- For item #17, consent to reasonable property inspections by the lender or IHDA to verify your statements.

- In item #18, confirm that the property is permanently affixed to land you own and is taxed as real property.

- Assert in item #19 that the land is for residential purposes and not designed for commercial use.

- In item #20, declare that you have made no material misstatements related to your mortgage application.

- Complete the borrower signature page with your signature and printed name, and if applicable, the co-borrower’s information.

- Fill out the notary section at the end of the document to finalize the affidavit.

- Once all fields are completed, save your changes, and download, print, or share the affidavit as required.

Complete your Borrower’s Affidavit online today to ensure a smooth mortgage application process.

The lender This is the person or entity that lends a certain amount of money on credit to an applicant, who is the borrower, who must repay the amount borrowed, plus the interest agreed upon in the contract, within a predetermined time frame.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.