Loading

Get Form 531

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 531 online

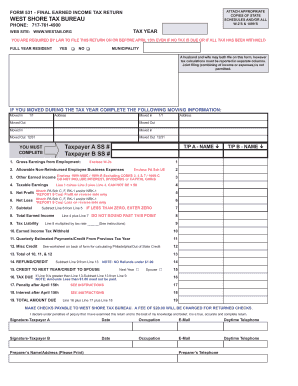

Filling out Form 531, the final earned income tax return, may seem daunting, but this guide will help you navigate the process smoothly. Whether you are a first-time filer or have previous experience, this guide offers clear, step-by-step instructions to assist you in completing the form accurately.

Follow the steps to easily complete Form 531 online.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen online platform.

- Identify your tax year on the form. Ensure the correct year is selected to avoid processing errors.

- If you are filing jointly with a partner, enter information for both individuals in the designated fields, ensuring that income calculations remain separate.

- If you relocated during the tax year, fill out the moving information by providing both the address you moved into and the address you moved out of, along with the respective dates.

- Begin entering your gross earnings from employment on Line 1. Ensure to enclose the necessary W-2 forms for verification.

- To calculate your taxable earnings, subtract Line 2 from Line 1 and add Line 3. Record this total on Line 4.

- Compute your subtotal by subtracting Line 6 from Line 5 and enter it on Line 7.

- Calculate your tax liability by multiplying Line 8 by the applicable tax rate and enter the figure on Line 9.

- Sum Lines 10, 11, and 12 to find your total credits and enter it on Line 13.

- If any tax is due, record this amount on Line 16, noting that amounts less than $1 do not need to be paid.

- Review all your entries for accuracy, ensuring all required documentation is attached before finalizing your return.

Start your filing process now and complete your Form 531 online easily.

Use this form if you are eligible to get part of your EIC (Earned Income Credit) in advance with your pay and choose to do so. http://.irs.gov/

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.