Loading

Get Tsd Withholding Licdorgagov Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tsd Withholding Licdorgagov Form online

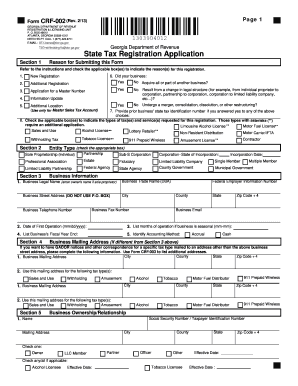

Filling out the Tsd withholding Licdorgagov form online is an important step for businesses in Georgia looking to register for state taxes. This comprehensive guide will walk you through each section of the form clearly and efficiently.

Follow the steps to complete the Tsd withholding Licdorgagov form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- In Section 1, state the reason for submitting this form by checking the applicable box. Options include new registration, additional registration, application for a master number, or information update.

- In Section 2, select the entity type by checking the appropriate box, which can range from sole proprietorship to corporation.

- In Section 3, fill in the business information, including the legal name, business address, telephone number, and email. Ensure to provide the date of first operation and any additional details regarding business structure.

- Section 4 requires you to provide a mailing address if it differs from the business address. You may also need to indicate which tax type should be sent to this address.

- In Section 5, provide the business ownership information, including names, titles, and corresponding social security numbers or taxpayer identification numbers.

- Complete Section 6 by checking the type of business activity and providing NAICS codes if known. Indicate the percentages of different business activities.

- For Section 7, answer whether your business will have employees and provide details about payroll responsibilities.

- Finally, complete Section 8 by providing an authorized signature, title, date, and contact information.

- Once all sections are completed, save the changes, download, print, or share the form as needed.

Begin completing your Tsd withholding Licdorgagov form online to ensure your business remains compliant with state tax regulations.

Claiming 0 allowances means that too much money will be withheld by the IRS. The allowances you can claim vary from situation to situation. If you are married with a kid, you can claim up to three allowances. If you want a higher tax return, you can claim 0 allowances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.