Loading

Get 16a See Rule 31(1)(b) Certificate Of Deduction Of Tax At Source Under Section 203 Of The Income-tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 16A See Rule 31(1)(b) Certificate Of Deduction Of Tax At Source Under Section 203 Of The Income-tax online

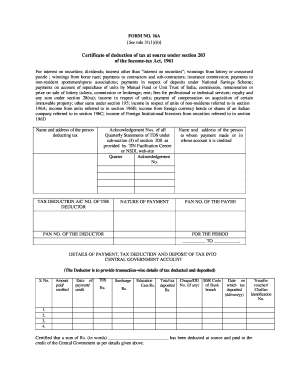

The 16A See Rule 31(1)(b) Certificate Of Deduction Of Tax At Source is a crucial document for reporting tax deductions made at source as per the Income-tax Act, 1961. Completing this form accurately is essential for compliance and for the benefit of those receiving income subject to tax deductions.

Follow the steps to complete the 16A Certificate of Deduction of Tax At Source online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the person deducting tax in the designated field. This information identifies the deductor and is essential for accuracy.

- Input the acknowledgment numbers for all quarterly statements of Tax Deducted at Source (TDS) as provided by the TIN Facilitation Centre or relevant website. This ensures all prior estimates are accounted for.

- Fill in the TAX DEDUCTION ACCOUNT NUMBER (TAN) of the deductor. This unique identifier is crucial for government records.

- Specify the nature of payment. This could include income types such as interest, dividends, winnings, or commissions. Accurate classification is key.

- Provide the Permanent Account Number (PAN) of the deductor. This verifies the deductor’s identity and complies with tax regulations.

- Next, enter the name and address of the person to whom payment has been made or credited. This information is necessary for tracking payments.

- Input the PAN of the payee. This is essential for ensuring that the payee’s information is correctly linked to the tax documents.

- Indicate the period for which the payment applies in the provided fields. Accurate dates are vital for record-keeping.

- Provide detailed transaction-wise information: amount paid, date of payment, TDS deducted, any applicable surcharges, and other tax-related charges. This specificity is critical for compliance.

- Complete the tax deposit details: add the cheque/DD BSR code (if applicable), and the date when tax was deposited.

- In the certification section, confirm the total sum deducted in words and numerals to ensure clarity.

- Finally, provide the place and date of signing, along with the signature and designation of the person responsible for the deduction of tax.

- Once all fields are filled accurately, save changes, download, print, or share the form as needed to complete your submission.

Complete your 16A form online now to ensure compliance and accurate tax reporting.

* To be applied in Form No. ... Standard Requirements for making an Applicant u/s 197 : Contact person (responsible for TDS) details: Income/Tax payment details: TAN details, if applicable. Details of Cumulative Tax likely to be foregone by issue of certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.