Loading

Get Sales And Use Tax Nc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales And Use Tax Nc online

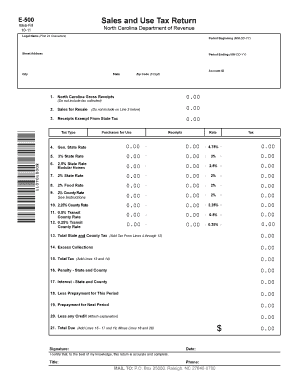

Filling out the Sales And Use Tax Nc form online is a straightforward process designed to help users report their sales and use tax obligations accurately. This guide provides clear, step-by-step instructions to assist you in completing each section of the form with confidence.

Follow the steps to fill out your Sales And Use Tax Nc form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your legal name in the first field, ensuring it does not exceed 24 characters.

- Indicate the beginning date of the reporting period in the format MM-DD-YY.

- Enter your street address, city, state, and zip code, ensuring accuracy for correspondence.

- Provide your Account ID, which is vital for processing your return.

- Record your total North Carolina gross receipts in Line 1.

- In Line 2, report sales for resale, ensuring not to include them in the total taxable receipts.

- Complete Line 3 by entering receipts exempt from state tax, specifying tax types as needed.

- Calculate the state tax rates for various categories from Lines 4 to 12, ensuring to note the amounts for each applicable rate.

- Add all calculated state and county taxes to find the total tax in Line 13.

- Record any excess collections in Line 14.

- Compute the total tax in Line 15 by adding Lines 13 and 14.

- Include any penalties or interest applicable in Lines 16 and 17.

- Deduct any prepayments for the current period shown in Line 18 and prepays for the next period in Line 19.

- Account for any credits in Line 20 by providing an explanation if necessary.

- Finally, compute the total amount due in Line 21 by summing the relevant amounts and completing any necessary subtractions.

- Sign and date the form, certifying its accuracy.

- Save, download, print, or share the completed form as needed.

Complete your Sales And Use Tax Nc form online today for a hassle-free filing experience.

A sales tax is what the state calls tax collected by a merchant in-state. ... Use tax is what the state calls a tax collected and remitted by what they deem a "remote seller" (i.e. someone who has sales tax in the state but isn't based there.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.