Loading

Get Nonprobate Transfers On Death (t

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NONPROBATE TRANSFERS ON DEATH (T) online

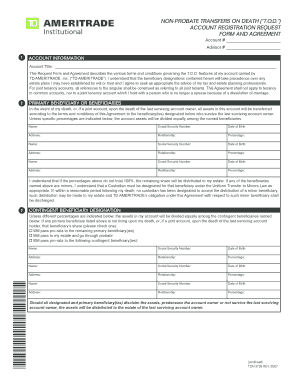

This guide provides step-by-step instructions for completing the NONPROBATE TRANSFERS ON DEATH (T) form. Understanding this document is essential for ensuring that your assets are distributed according to your wishes after your passing.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the account information section by providing your account title and ensuring that all information is accurate.

- Identify and list the primary beneficiary or beneficiaries. For each, include their name, social security number, date of birth, address, relationship to you, and the percentage of the account assets they will receive.

- Understand that if the total percentage does not equal 100%, the remaining assets will go to your estate. If any beneficiaries are minors, designate a custodian for their share.

- Proceed to the contingent beneficiary designation section. List any contingent beneficiaries and similar details as you did for the primary beneficiaries.

- Decide how shares will be distributed if a primary beneficiary predeceases you by selecting the appropriate option.

- Review the terms and conditions thoroughly to ensure understanding and compliance.

- Finally, sign the form, date it, and confirm all information is accurate before submitting.

Complete your documents online to ensure the timely and accurate transfer of your assets.

Estate assets are those assets that will pass in accordance with your Will. They are those assets held in your personal name or as tenants in common with another person. Examples of estate assets are property, shares or motor vehicles owned solely by you or as a tenant in common with another person.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.