Loading

Get 20549 Schedule To (rule 14d-100) Tender Offer Statement Under Section 14(d)(1) Or 13(e)(1) Of The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 20549 Schedule To (Rule 14D-100) Tender Offer Statement under Section 14(d)(1) or 13(e)(1) online

Filling out the 20549 Schedule To (Rule 14D-100) is an essential step for those involved in tender offers. This guide provides clear and concise instructions to help you successfully complete the form online, ensuring compliance with necessary requirements.

Follow the steps to fill out the 20549 Schedule To online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

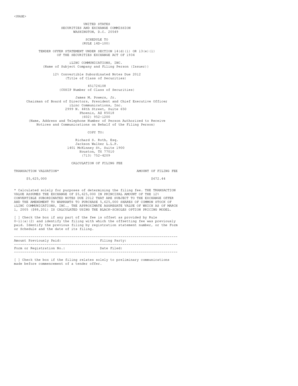

- Provide the name of the subject company, which is iLinc Communications, Inc., and include the title of the class of securities, entered as '12% Convertible Subordinated Notes Due 2012'.

- Fill in the CUSIP number for the class of securities: '451724108'.

- Input the name and contact information for the person authorized to receive notices and communications on behalf of the filing person.

- Calculate the transaction valuation and filing fee. Include the amounts '5,625,000' for transaction value and '672.44' for the filing fee.

- Designate the type of transaction by checking the applicable boxes — in this case, check 'Issuer tender offer subject to Rule 13e-4'.

- Provide a summary term sheet by incorporating information from the Offer to Exchange if required, maintaining clarity and brevity.

- Complete each item, incorporating summaries and information from the Offer to Exchange regarding the subject company, terms of the transaction, funds, and sections regarding interests in securities.

- Sign and date the document, certifying the information is true and correct.

- Save your changes, then download or print the completed form for submission.

Complete your documents online efficiently and ensure compliance with the necessary regulations.

A tender offer might, for instance, be made to purchase outstanding stock shares for $18 a share when the current market price is only $15 a share. The reason for offering the premium is to induce a large number of shareholders to sell their shares.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.