Loading

Get Annuity Suitability & Disclosure Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the annuity suitability & disclosure form online

Filling out the annuity suitability & disclosure form online is an essential step in ensuring your investment aligns with your financial goals. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to access the annuity suitability & disclosure form online and open it in your chosen editor.

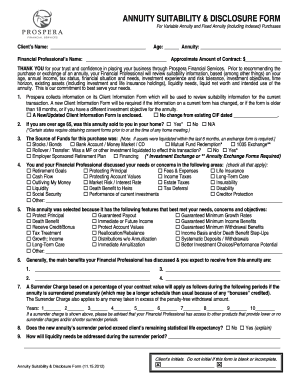

- Begin by entering the client’s name in the designated field. This is crucial for identifying the individual for whom the annuity is intended.

- Input the age of the client; this information helps assess suitability based on age-related financial considerations.

- Select the type of annuity from the provided options. This will guide the financial professional in tailoring advice and recommendations.

- Fill in the financial professional’s name, as well as the approximate amount of the contract being considered.

- Review and indicate if a new or updated client information form is enclosed. This is necessary to ensure the most relevant financial information is used.

- If applicable, indicate whether the annuity was sold during a home meeting for clients over age 65.

- Specify the source of funds for the annuity purchase by selecting the appropriate option from the list.

- Discuss and check all areas of concern that were addressed in the conversation with the financial professional, as these are key factors in decision-making.

- Explain why this particular annuity was selected based on its features using the checkboxes provided.

- Describe the main benefits expected from the annuity by filling in the corresponding fields.

- Complete the surrender charge section, providing the necessary timeframes and percentages for review.

- Explain how liquidity needs will be met throughout the surrender period, ensuring a thorough understanding of cash availability.

- Indicate the intended use of the annuity and, if applicable, whether life insurance was discussed as an alternative.

- List any other investment options that were explored as alternatives to this annuity.

- Detail the percentage of total investments in annuities relative to the stated liquid net worth.

- Acknowledge any tax issues related to withdrawals and the implications for individuals under age 59½.

- Complete the fees and expenses section, providing details on applicable charges.

- Review important general disclosures related to the annuity transactions, confirming understanding.

- Fill in any additional comments and provide signatures, ensuring that all information is complete and accurate before submission.

Complete your annuity suitability & disclosure form online today to secure your financial future.

Single premium immediate annuities, which is the original pension type of annuity, can pretty much be issued at any age. In my opinion, annuities should be looked at by people around their fifties going toward retirement or in retirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.