Loading

Get 2013 Tc-65 Forms, Utah Partnership/llp/llc Return - Tax Utah

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

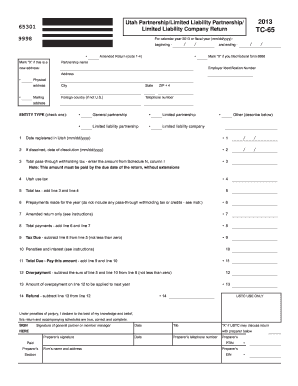

How to fill out the 2013 TC-65 Forms, Utah Partnership/LLP/LLC Return - Tax Utah online

Filing the 2013 TC-65 form is essential for partnerships, limited liability partnerships, and limited liability companies operating in Utah. This guide provides comprehensive steps to assist users in completing the form online with clarity and support.

Follow the steps to successfully complete the TC-65 form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the calendar or fiscal year information at the top of the form, providing the appropriate dates in mm/dd/yyyy format for both the beginning and ending of the period.

- Complete the entity type section by selecting whether the entity is a general partnership, limited liability partnership, or limited liability company. Review the options carefully to ensure you choose the correct format.

- Fill in the Employer Identification Number (EIN) of the entity, then provide the name, address, city, and state of the partnership, along with any physical address details.

- Indicate if the entity filed a federal form and if applicable, include details about any resolved issues or clarifications related to the entity's tax status.

- Report the total pass-through income, expenses, and any taxes due according to the form's specifications, ensuring accurate calculations from the provided schedules.

- Complete the requisite schedules such as Schedule A for Taxable Income, Schedule H for Nonbusiness Income, and any additional schedules necessary for tax credit computations.

- After ensuring all fields are accurately filled, review the information to confirm completeness and correctness before submission.

- Save your changes, and then you can download, print, or share the form as needed.

Begin the process and complete your documents online today.

Q-7: Does Utah allow a composite partnership filing on Utah form TC-65? A-7: No. Composite partnership returns are no longer an option effective for tax years beginning in 2009. They were replaced by the Utah pass-through entity withholding tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.