Loading

Get Immigrant Status In Canada. A Beneficiary Can Use This Form To Declare To The R Gie His Or Her

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Immigrant Status In Canada. A Beneficiary Can Use This Form To Declare To The R Gie His Or Her online

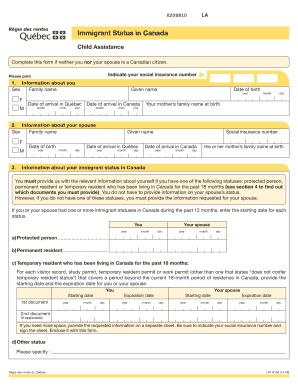

This guide provides a comprehensive overview of how to complete the Immigrant Status form in Canada. Designed for beneficiaries, this form assists users in declaring their immigrant status to the Régie des rentes du Québec online.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill out personal information in section one, including your sex, family name, given name, and dates of arrival in Québec and Canada.

- Provide information about your spouse in section two, including their sex, family name, given name, and dates of birth and arrival.

- In section three, describe your immigrant status. Indicate if you are a protected person, permanent resident, or temporary resident. Include details of any relevant documents and statuses held in the past 12 months.

- In section four, attach documents as proof of your immigrant status. Ensure these are originals or true copies, and indicate any additional information needed if the space provided is insufficient.

- Complete the declaration section by signing and dating the form. If someone else completed the form for you, include their information below.

- Review your form to ensure all information is complete and accurate. Save your changes.

- You can then download, print, or share the form as required, or return it by mail to the Régie des rentes du Québec.

Prepare and submit your documents online to ensure efficient processing.

Form I-485, Application to Register Permanent Residence or Adjust Status, is used by a person in the United States to apply for lawful permanent resident status. Throughout these Instructions, we will sometimes refer to Form I-485 as an application for adjustment of status or as an adjustment application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.