Loading

Get Qualified Plan Qdro Distribution Request - Principal Trust Company

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qualified Plan QDRO Distribution Request - Principal Trust Company online

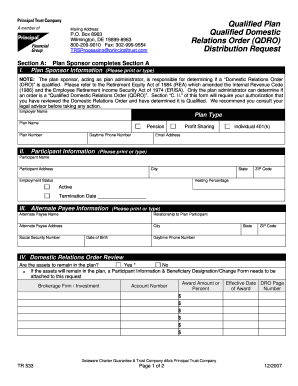

Filling out the Qualified Plan QDRO Distribution Request is an essential step in managing retirement assets during divorce or separation. This guide provides clear, step-by-step instructions to help you complete the form efficiently and accurately.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- In Section A, enter the plan sponsor information. Include the employer name, plan type, and plan name, as well as the plan number. Ensure all information is accurate and printed or typed clearly.

- Provide your daytime phone number and email address in the Participant Information section. Clearly print the participant's name, address, city, state, and ZIP code.

- Indicate the employment status and vesting percentage of the participant. If applicable, provide the termination date.

- In Section III, fill in the Alternate Payee Information. This includes the alternate payee's name, relationship to the plan participant, address, social security number, date of birth, and daytime phone number.

- In the Domestic Relations Order Review subsection, specify whether the assets will remain in the plan. If they will, ensure to attach the necessary Participant Information & Beneficiary Designation/Change Form.

- Complete Section B, where the alternate payee must review important distribution information and select the distribution type and method. Options include direct rollover or in-cash methods.

- In the Payment Information section, indicate where checks should be made payable and provide the name and mailing address of the financial institution or account to which the funds will be sent.

- Both the alternate payee and plan sponsor must sign Section C after confirming they understand the information and agree to the certification statements. Include dates as required.

- After completing all sections, make sure to save your changes, download the form, or print it for your records. You may also share it if needed.

Get started on your document today to ensure proper management of your retirement assets.

Distributions made pursuant to QDROs are generally taxed in the same manner as any other typical plan distribution. One key difference is that a cash-out distribution from a QDRO is not subject to the 10% early withdrawal penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.