Loading

Get Asset Disposition List

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Asset Disposition List online

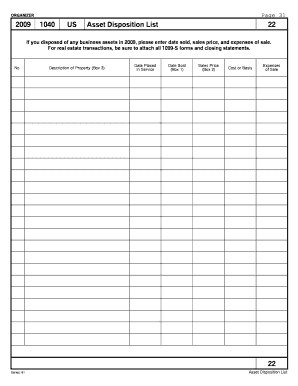

The Asset Disposition List is a crucial document for reporting the sale of business assets. This guide will provide you with clear and detailed instructions on how to accurately complete the form online, ensuring that all necessary information is properly recorded.

Follow the steps to complete the Asset Disposition List with confidence.

- Press the ‘Get Form’ button to access the Asset Disposition List and open it for editing.

- In the form, you will see fields for entering details about each disposed asset. Begin by filling out the 'Description of Property' field to identify each asset.

- Next, indicate the ‘Date Placed in Service’ which is the date the asset was first used for business purposes.

- Then, in 'Date Sold', enter the exact date the asset was sold. This information is critical for tracking purposes.

- In the 'Sales Price' field, provide the amount you received from the sale of the asset.

- Fill out the 'Cost or Basis' section, which reflects the original purchase price of the asset, adjusted for any improvements or depreciation.

- Lastly, document any additional costs associated with the sale in the 'Expenses of Sale' section. This includes fees and commissions related to the transaction.

- Once all fields are completed and verified, you may save your changes, download a copy, print it for your records, or share it with relevant parties.

Complete your documents online today to ensure proper asset reporting.

Unrecaptured section 1250 gain is an Internal Revenue Service (IRS) tax provision where previously recognized depreciation is recaptured into income when a gain is realized on the sale of depreciable real estate property. Unrecaptured section 1250 gains are taxed at a maximum 25% tax rate, or less in some cases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.