Loading

Get Form 150 206 029

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 150 206 029 online

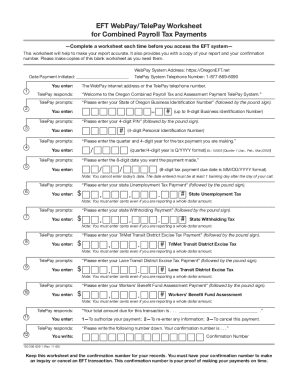

Filling out the Form 150 206 029 online is a straightforward process designed to facilitate electronic payroll tax payments through the Oregon Department of Revenue. This guide provides step-by-step instructions to ensure that users, regardless of their legal experience, can complete the form accurately and efficiently.

Follow the steps to fill out the Form 150 206 029 online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your Oregon Business Identification Number (BIN) in the designated field. Ensure this number is current and active for payroll taxes.

- Select whether you are submitting a new application or making a change to an existing application by checking the appropriate box.

- Fill in your business name as registered with your financial institution. Provide your Federal Employer Identification Number (FEIN) on the relevant line.

- Complete the contact information fields including your business address, city, state, and ZIP code.

- Designate an EFT contact person by providing their name, telephone number, email address, and fax number.

- Indicate whether the account to be debited is a business checking or savings account by selecting the appropriate option.

- Provide the name of your financial institution, along with the branch name or address, city, state, ZIP code, account number, and routing number.

- Sign and date the application. Ensure all signatures match the name printed on the form.

- Attach a voided check or a letter from your financial institution to the completed application as required.

- Submit the completed form to the EFT Coordinator at the Oregon Department of Revenue via mail or fax. Retain a copy for your records.

Complete the Form 150 206 029 online today to streamline your payroll tax payment process.

Employers may use a 8 percent flat rate to figure withholding on supplemental wages that are paid at a different time than an employee's regular payday. Supplemental wages include bonuses, overtime pay, commissions, or any other form of payment received in addition to the employee's regular pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.