Loading

Get Rmd Request Form - Dreyfus

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RMD Request Form - Dreyfus online

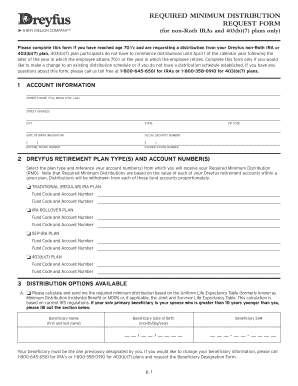

Filling out the RMD Request Form - Dreyfus is a vital step for individuals over the age of 70 1/2 who wish to request distributions from their non-Roth IRA or 403(b)(7) plans. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the RMD Request Form - Dreyfus

- Press the ‘Get Form’ button to access the required form and open it for editing.

- Fill in the account information section, including the owner’s name, street address, city, state, date of birth, social security number, daytime phone number, evening phone number, and zip code.

- Select the applicable Dreyfus retirement plan type(s) and enter your account number(s) from which you will receive your required minimum distribution (RMD). Choose from options such as Traditional IRA, IRA Rollover, SEP-IRA, or 403(b)(7) plan.

- In the Distribution Options section, choose whether you want the required minimum distribution calculated based on IRS tables or specify a greater amount. Enter the beneficiary information if necessary.

- Complete the Federal Income Tax Withholding section. Indicate whether you want 10% withholding applied to your distribution or if you choose not to apply withholding.

- Set up your Periodic Distributions if you want to request an initial RMD and/or establish a regular schedule of distributions. Indicate whether you want to postpone your first RMD or the desired schedule.

- Provide your Distribution Instructions by selecting one of the options for receiving your funds, including crediting to an existing account, receiving a check at an alternate address, or opting for Automated Clearing House (ACH) transfers.

- Review and complete the Participant Authorization section. Ensure that all certifications regarding your Social Security Number and tax status are filled out correctly.

- Sign and date the form. If applicable, include a medallion signature guarantee in required cases.

- Finally, save your changes, download the completed form, print it, or share it as needed.

Start filling out your RMD Request Form - Dreyfus online today!

For RMDs, you'll receive a Form 1099-R with a Distribution Code of 7 for normal distributions there is no other IRA required minimum distribution tax form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.