Loading

Get Authorization To Release Form A Revenue Clearance ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

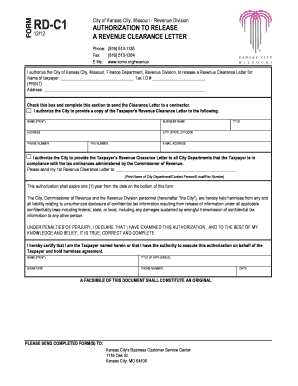

How to fill out the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE online

This guide provides a step-by-step approach to filling out the Authorization to Release Form A Revenue Clearance online. Users will receive clear instructions tailored to their needs, ensuring a smooth and efficient process.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the name of the taxpayer in the designated field. Ensure to print the name clearly.

- Next, input the Tax Identification Number (Tax I.D.#) of the taxpayer in the specified section.

- Fill in the complete address of the taxpayer in the provided area, ensuring all details are accurate.

- If you wish to send the Clearance Letter to a contractor, check the specified box and complete the contractor's details, including name, business name, address, city, state, ZIP code, phone number, fax number, title, and email address.

- Indicate the City Department or Contact Person to which the Revenue Clearance Letter should be sent. Include their name, email, and fax number as required.

- Review the authorization expiration note indicating that it will expire one year from the date noted at the bottom of the form.

- Acknowledge the hold harmless agreement regarding unauthorized disclosure of confidential tax information.

- Under penalties of perjury, declare that the information provided is true, correct, and complete. Print your name in the specified area.

- If applicable, include your title, and provide your signature and phone number in the designated fields.

- Finally, save any changes made to the form, then download, print, or share it according to your needs.

Start filling out the Authorization to Release Form A Revenue Clearance online today.

A taxpayer can also request a Tax Clearance Letter (status of account) to be used when applying for certain federal grants or loans. While this letter provides the status of an account, it does not exempt the business from future audits that may cover periods before the business was sold.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.