Loading

Get Form Dt Company

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Dt Company online

This guide provides a comprehensive overview of how to fill out the Form Dt Company online, ensuring a smooth process for applicants. By following the step-by-step instructions, users can navigate the form effectively and apply for relief from UK income tax on interest and royalties.

Follow the steps to complete the Form Dt Company online.

- Click 'Get Form' button to obtain the form and open it in the editor.

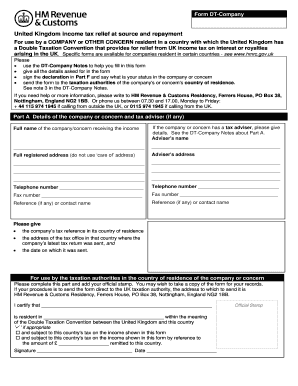

- Fill in Part A with the details of the company or concern. Include the full name, registered address, and details of any tax adviser if applicable. Be sure to provide a telephone number and include any relevant references.

- Proceed to Part B, where you will answer various questions about the company or concern. Ensure to answer all yes/no questions accurately, providing additional details as necessary.

- In Part C, select the appropriate section for your application. C1 is for interest from loans, C2 for interest from UK securities, and C3 for royalties. Complete the required columns, ensuring all information is accurate and attach any necessary supporting documentation.

- If applicable, move to Part D to claim any repayment for UK income tax that has been deducted from payments received. Provide all required details.

- Complete Part E if you wish for repayment to be directed to a bank or nominee. Include necessary bank details.

- Finally, sign the declaration in Part F certifying that all information is correct and complete. Include your name and role in the company where required.

Complete your Form Dt Company application online today for a smooth filing experience.

Related links form

Double Taxation Treaty Relief (Form DT Company)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.