Loading

Get Iht410

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht410 online

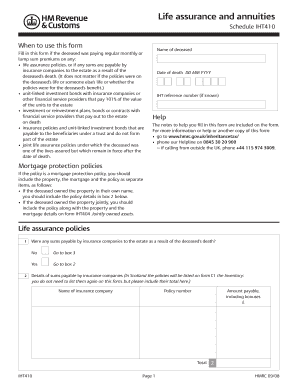

The Iht410 form is essential for reporting life assurance and annuities related to a deceased individual. This guide will help you navigate each section of the form with clear and concise instructions, ensuring a smooth online filing process.

Follow the steps to successfully complete the Iht410 form.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the name of the deceased in the designated field. Ensure that all names are spelled correctly.

- Input the date of death in the format DD MM YYYY. This information is crucial for processing the Iht410.

- If known, include the IHT reference number in the appropriate box.

- Proceed to the section regarding insurance companies. Answer whether any sums were payable to the estate as a result of the deceased's death. If 'Yes', fill in the company name, policy number, and the amount payable, including bonuses.

- If applicable, provide details of any jointly owned assurance policy. If such a policy exists, direct yourself to fill out form IHT404.

- Continue to the annuity section. Indicate if payments made under a purchased life annuity continued after the deceased's death. Fill in the details including the name of the company, frequency of repayments, any payment increases, and the date of the final guaranteed payment.

- If a lump sum was payable under a purchased life annuity upon the deceased's death, provide details similarly, ensuring you include the total value.

- Check for any life assurance premiums paid on behalf of others within the seven years prior to death. Provide necessary details if applicable.

- Review all entries for accuracy and completeness before proceeding to save, download, print, or share the form as needed.

Complete your documents online today!

Life assurance policies offer insurance cover for the whole of your life, rather than a chosen policy length. A life assurance payout is tax-free, and provided the premiums have been paid, a claim can be made upon the death of the insured person.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.