Loading

Get Irs Issues Coli Reporting Form 8925 - Mesirow Financial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Issues COLI Reporting Form 8925 - Mesirow Financial online

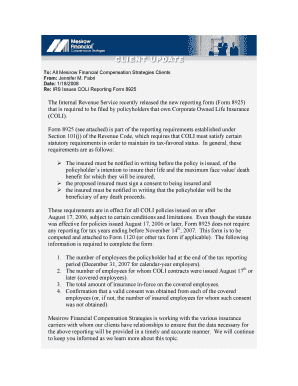

Filling out the IRS Issues COLI Reporting Form 8925 is an essential task for policyholders of Corporate Owned Life Insurance. This guide offers a detailed, step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your organization's name and address in the designated fields. Ensure this information matches what is on file with the IRS.

- Indicate the number of employees you had at the end of the tax reporting period, which for calendar-year employers would be December 31 of the previous year.

- Next, provide the number of covered employees – those for whom COLI contracts were issued on or after August 17, 2006.

- Fill in the total amount of insurance in-force on the covered employees. This figure represents the total death benefit available under the COLI policies held.

- Confirm whether valid consent was obtained from each covered employee for the policies. If consent was not obtained, specify the number of insured employees for whom consent was not granted.

- Review all the information entered in the form for accuracy. Make any necessary corrections.

- Once completed, you can save changes, download, print, or share the form as needed for your records or submissions.

Start filling out your IRS Issues COLI Reporting Form 8925 online today!

Generally, beneficiaries do not pay income tax on money or property that they inherit, but there are exceptions for retirement accounts, life insurance proceeds, and savings bond interest. Money inherited from a 401(k), 403(b), or IRA is taxable if that money was tax deductible when it was contributed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.