Loading

Get Clear To Close Checklist All Loans

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Clear To Close Checklist All Loans online

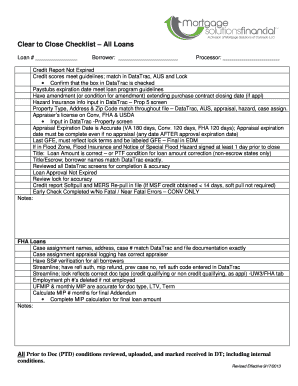

The Clear To Close Checklist is an essential document that ensures all necessary conditions for loan approval are met. This guide will provide you with clear, step-by-step instructions on how to fill out the checklist accurately online.

Follow the steps to complete your Clear To Close Checklist.

- Press the ‘Get Form’ button to access the Clear To Close Checklist and open it in your preferred editing tool.

- Enter the loan number in the designated field. Ensure that this number is accurate, as it will be used to track the loan throughout the process.

- Fill in the borrower information, including their full name, ensuring it's entered correctly as it appears in all loan documents.

- Provide the processor's name in the appropriate field. This individual will oversee the loan processing and should be accurately identified.

- Confirm that the credit report is valid and not expired. Ensure the credit scores meet the required guidelines, and that these match in DataTrac, AUS, and Lock systems.

- Check that the paystubs' expiration dates conform to the loan program's standards.

- If applicable, ensure there is an amendment or condition extending the purchase contract closing date.

- Input hazard insurance information into the DataTrac system, specifically in the Property 5 screen.

- Verify that the property type, address, and ZIP code are consistent across all documents, including DataTrac, AUS, appraisal, and hazard information.

- Confirm the appraiser's license is valid for Conventional, FHA, and USDA loans, and enter this in the Property screen in DataTrac.

- Ensure the appraisal expiration date is accurately recorded. Note specific timelines for VA, Conventional, and FHA loans.

- Review the last Good Faith Estimate (GFE) to ensure it reflects the lock terms. Label it clearly as GFE – Final in the document management system.

- If the property is in a flood zone, verify that flood insurance is in place and that the Notice of Special Flood Hazard has been signed at least one day prior to closing.

- Check that the loan amount is accurate on the title, and denote if there is a condition needed for loan amount correction in non-escrow states.

- Make sure borrower names match exactly with those in DataTrac across title and escrow documentation.

- Thoroughly review all screens in DataTrac for completion and accuracy.

- Affirm that the loan approval has not expired and review all locks for accuracy.

- Confirm that any necessary soft pull credit reports and MERS re-pulls are included in the file.

- Complete an early check to identify any errors, making sure none are fatal or near fatal for Conventional loans.

- For FHA loans, ensure that case assignment information matches DataTrac and file documentation precisely.

- Verify Social Security number for all borrowers and include all required refinance authorizations in DataTrac.

- Ensure employment phone numbers are removed if not employed, and validate that UFMIP and monthly MIP amounts are correct.

- Calculate the final amount of MIP over the requisite number of months, and document this for the final addendum.

- Before submitting, ensure that all prior to document conditions have been reviewed, uploaded, and marked as received in DataTrac.

- Once all fields are accurately completed and checked, save your changes, download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth loan processing experience.

"Clear to Close" means the Underwriter has signed-off on all documents and issued a final approval. The mortgage team schedules your closing and reviews the Closing Disclosure (CD). The CD is the standardized document that details the finalized terms for the loan, including a breakdown of all costs and fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.