Loading

Get Ntb Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ntb Form online

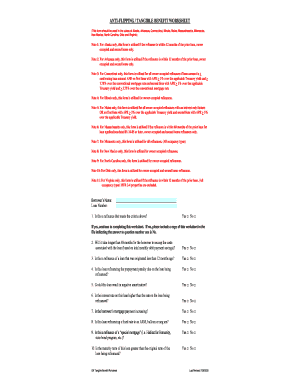

Filling out the Ntb Form is a crucial step for users seeking to refinance under specific conditions. This guide provides a step-by-step approach to ensure the form is completed accurately and efficiently.

Follow the steps to fill out the Ntb Form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with the loan number section at the top of the form. Enter the specific loan number associated with the refinancing application.

- For the first question, determine if the refinance meets the outlined criteria. Select 'Yes' or 'No' accordingly; if 'No', include a copy of this worksheet in the file indicating that the answer is 'No'.

- In the second question, assess whether it will take longer than 48 months for the borrower to recoup costs. Select the appropriate option, 'Yes' or 'No'.

- Address the third question regarding the origination of the loan within the last 12 months. Choose 'Yes' or 'No'.

- For question four, evaluate if the loan is refinancing a prepayment penalty due on the loan being refinanced, and select 'Yes' or 'No'.

- Consider question five, which addresses the potential for negative amortization. Choose 'Yes' or 'No'.

- Next, in question six, determine if the interest rate on this loan is higher than the rate on the loan being refinanced. Select accordingly.

- Proceed to question seven about whether the payment is increasing. Answer with 'Yes' or 'No'.

- In question eight, assess if the loan changes from a fixed rate to an adjustable-rate mortgage or another type. Choose 'Yes' or 'No'.

- For question nine, confirm if the loan is part of a state bond program or similar. Select 'Yes' or 'No'.

- Finally, review question ten regarding the maturity term of the loan. Choose the correct response.

- If any of the answers to the questions above were 'Yes', provide an explanation on how the loan benefits the borrower in the space provided.

- Complete the section at the bottom of the form by signing your name and entering the date of completion.

- Once all sections are filled out, you can save changes, download, print, or share the completed form as needed.

Start filling out your Ntb Form online today to streamline your refinancing process.

Net Tangible Benefit 5% Payment Reduction FHA defines a net tangible benefit as the mortgage payment dropping by at least 5%. The reduction must factor in principal, interest, and mortgage insurance. For example, a borrower currently has a 30 year fixed note rate at say 5% on a $200,000 loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.