Loading

Get 2013 Form W-4 - Consumer Direct Missouri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Form W-4 - Consumer Direct Missouri online

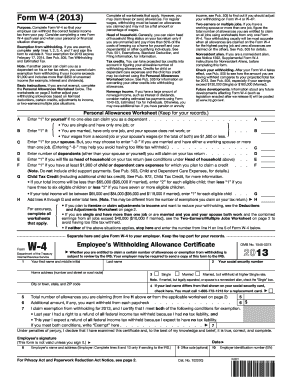

Completing the 2013 Form W-4 is essential for ensuring proper federal income tax withholding from your pay. This guide will help you navigate through the form, providing step-by-step instructions that cater to all users, regardless of their familiarity with tax documents.

Follow the steps to fill out the 2013 Form W-4 - Consumer Direct Missouri online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin filling out your personal information. Enter your first name, middle initial, last name, home address, city, state, and ZIP code. Ensure that the name matches the one on your social security card. If your last name differs, check the designated box and follow up with the Social Security Administration.

- Select your filing status by marking the appropriate box: Single, Married, or Married but withhold at a higher Single rate. Remember, if you are married and legally separated or if your spouse is a nonresident alien, check the Single box.

- Determine the total number of allowances you wish to claim. Use the Personal Allowances Worksheet on page 1 to assist you. The higher the number of allowances, the less tax will be withheld from your pay.

- If you wish to have an additional amount withheld from each paycheck, enter that amount in the space provided. This can help prevent under-withholding.

- If applicable, complete the section on claiming exemption from withholding by confirming that you meet the required conditions. If so, write 'Exempt' in the provided area.

- Sign and date the form to validate it. The form is not considered complete without your signature.

- Separate the form and keep the top part for your records. Provide the completed form to your employer.

- Finally, assess if you need to use the Deductions and Adjustments Worksheet or the Two-Earners/Multiple Jobs Worksheet as necessary. This will ensure that your withholding is accurate based on your unique financial circumstances.

Complete your documents online today to ensure accuracy and compliance with tax regulations.

Step 1: Enter Personal Information. ... Step 2: Multiple Jobs or Spouse Works. ... Step 3: Claim Dependents. ... Step 4: Other Adjustments. ... Step 5: Sign the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.