Loading

Get Form De2210 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form De2210 2015 online

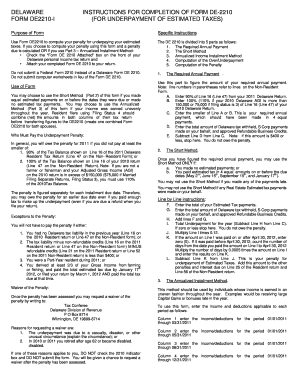

Filling out Form De2210 2015 online can be straightforward with the right guidance. This form is used to calculate your penalty for underpaying estimated taxes in Delaware and requires careful attention to detail in each section.

Follow the steps to complete the form effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen online platform.

- Start with Part 1, Required Annual Payment, and enter the appropriate figures: A. 90% of Line 16 from your 2011 Delaware Return; B. 100% (or 110% if applicable) of Line 16 from your 2010 Delaware Return. Then, enter the smaller of these two amounts.

- In Part 2, Short Method, determine if you qualify. If you made equal estimated payments on time or made none, proceed with this section. If late payments were made, skip to Part 3.

- If using the Short Method, complete the required calculations, including total payments and expenses as detailed on the form.

- For Part 3, Annualized Income Installment Method, enter your income and deductions for each relevant period. Ensure you fill out all columns accurately based on when income was earned.

- Continue filling out Parts 4 and 5, including the computation of over/under payment and the penalty calculation. Ensure you follow each line’s instructions closely.

- Review all entries for accuracy. Ensure the form is complete, checking for any required attachments to send with your Delaware personal income tax return.

- Once you have filled out the form, you can save the changes, download it, print it, or share it as necessary for your submission.

Complete your documents online efficiently with this guide to ensure accurate submissions.

Related links form

You may need this form if: You're self-employed or have other income that isn't subject to withholding, such as investment income. You don't make estimated tax payments or paid too little. You don't have enough taxes withheld from your paycheck.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.