Loading

Get Form Pwh Ww Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Pwh Ww Instructions online

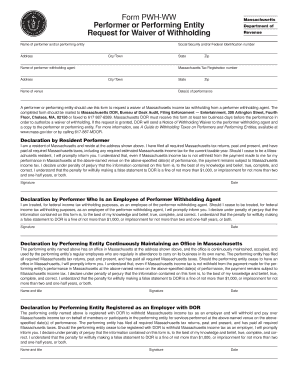

The Form Pwh Ww Instructions is a critical document used to request a waiver of withholding tax for performances in Massachusetts. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring you understand each section and field.

Follow the steps to successfully fill out the Form Pwh Ww Instructions online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, enter the name of the performer or performing entity. Provide the complete address, including street, city/town, state, and zip code. Make sure the details are accurate as they are essential for identification.

- Next, input the social security number or federal identification number in the designated field. This information is necessary for tax identification purposes.

- Identify the performer withholding agent by stating their name and address, similar to how you filled out the previous fields. This should also include the Massachusetts tax registration number.

- Indicate the name of the venue where the performance will take place, along with the zip code.

- Specify the date or dates of the performance. Ensure the dates are accurate as they will be used to determine the time frame for the waiver request.

- Complete the declaration section applicable to you, such as resident performer, nonresident performer, or performing entity. Sign and date the form upon review, confirming that all provided information is accurate.

- Once all sections are completed, you can save your changes, download the form, print it, or share it as needed. Make sure to submit the form to the Massachusetts DOR at least ten business days before the performance.

Complete your Form Pwh Ww Instructions online today and ensure you meet your performance tax requirements.

If you want to get more money back in your tax refund each year, you can designate that a larger amount of your paycheck is withheld. It's simple -- just enter the extra amount you want withheld from each paycheck on line 4(c) of your W-4 form. The line is marked "Extra withholding."

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.