Loading

Get Fillable 73a902

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Fillable 73a902 online

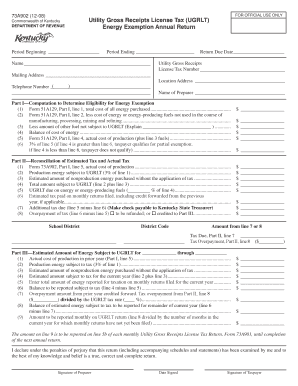

The Fillable 73a902 form is essential for individuals or organizations seeking an annual energy exemption under the Utility Gross Receipts License Tax in Kentucky. This guide provides clear, step-by-step instructions to help you accurately complete and submit the form online, ensuring compliance and maximized benefits.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to access the Fillable 73a902 and open it in your preferred document editor.

- In the first section, enter the period beginning and ending dates of the reporting year. This helps define the timeframe for which you are filing the return.

- Provide your name, utility gross receipts license tax number, and contact information, including your mailing and location addresses along with your telephone number.

- Complete Part I, where you will calculate your eligibility for the energy exemption. Fill in the total cost of all energy purchased and deductions as outlined in the form, ensuring to document any other fuels not subject to the tax.

- If your calculations show that the balance of cost exceeds the 3 percent threshold, continue filling out the return. In Part II, reconcile the estimated tax versus the actual tax through the provided lines, ensuring to include any additional taxes due or overpayment for a refund.

- In Part III, estimate the amount of energy subject to tax for the current year, utilizing data from your previous year's production costs, and determine the balance to be reported monthly.

- Finally, review all information for accuracy, then save your changes. Choose to download, print, or share the completed form as necessary while ensuring you maintain a copy for your records.

Complete your Fillable 73a902 form online today for a smooth filing experience.

ing to the Kentucky Energy and Environment Cabinet, starting in January, if Kentuckians own or rent more than one property in the state, they'll pay a 6% sales tax on utilities. Specifically, that means electricity, gas, water, sewer and other services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.