Loading

Get Rpd 41369 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rpd 41369 2019 online

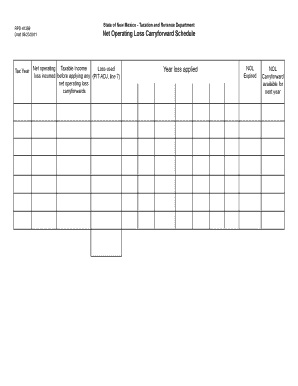

This guide provides clear instructions for completing the Rpd 41369 form online. Designed for users with various levels of experience, the following steps aim to simplify the process of reporting net operating loss carryforwards in New Mexico.

Follow the steps to successfully complete the Rpd 41369 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year in the first column, using the format mm/dd/yyyy for the last day of the tax year.

- In the next field, input the net operating loss incurred during the reported tax year as listed in the first column.

- Provide the taxable income before applying any net operating loss carryforward in the designated space for the reported tax year.

- Document the loss used during the current tax year, ensuring this amount matches the line 7 from Schedule PIT-ADJ.

- At the top of the next column, input the last day of the tax year when the net operating loss in the previous column was utilized.

- Continue to fill in the applicable row with the amount of loss used for the indicated tax year and follow this for all previous tax years.

- Register any expired net operating losses which could not be deducted due to the expiration of the carryforward period.

- Indicate the amount of net operating loss available for carryforward to the next year.

- After completing all fields, review your entries, save any changes, and download, print, or share the form as needed.

Complete your Rpd 41369 document online today for an efficient filing experience.

Federal Forms Available locally at: Internal Revenue Service. 5338 Montgomery Blvd NE. Phone: 837-5631. Federal Tax Information: 1-800-829-1040. Taxpayer Advocate Service: (505) 837-5505 in Albuquerque. 1-877-777-4778 elsewhere.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.