Loading

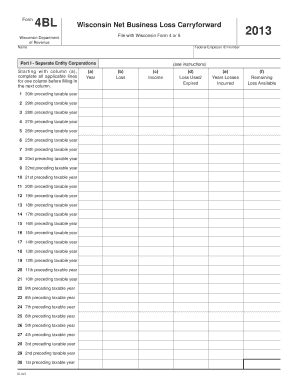

Get 2013 Ic-047 Form 4bl Wisconsin Net Business Loss Carryforward. Wisconsin Net Business Loss

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 IC-047 Form 4BL Wisconsin Net Business Loss Carryforward online

Filling out the 2013 IC-047 Form 4BL is an essential step for businesses in Wisconsin looking to carry forward net business losses. This guide will provide comprehensive and step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editing tool.

- Begin by entering your name and Federal Employer ID Number at the top of the form. This identification will help the Wisconsin Department of Revenue process your form correctly.

- Proceed to Part I for separate entity corporations. In column (a), list the years for which you are reporting net business losses, beginning with the 30th preceding taxable year down to the 1st preceding taxable year.

- In column (b), enter the losses incurred for each corresponding year listed in column (a). Make sure to provide accurate figures to reflect your business's financial situation.

- In column (c), provide the income earned in each specific year, as this will be necessary for calculating the losses used or expired.

- Continue to column (d) to indicate how much of each loss was used or expired during the specific years, ensuring you maintain accurate records.

- In column (e), record the years in which the losses were incurred, helping to clarify the timeline of your business's net losses.

- For columns (f), calculate and input the remaining loss available after accounting for any losses used or expired.

- If applicable, complete Part II for combined group members following the same approach as Part I, ensuring to detail losses and income for group members.

- Once all sections are completed and reviewed for accuracy, save your changes, and you have the option to download, print, or share the form as needed.

Be proactive and complete your Wisconsin Net Business Loss Carryforward form online today!

Purpose of Form 4BL A corporation that files as a separate entity uses Form 4BL to determine the amount of available net business loss carryforward for the current year. Corporations that are members of a combined group must complete Form 6BL on a separate company basis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.