Loading

Get 2643a Missouri Tax Registration Application - Formupack

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2643A Missouri Tax Registration Application - FormuPack online

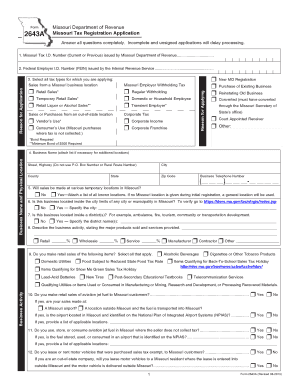

The 2643A Missouri Tax Registration Application is a crucial document for individuals and entities wishing to register their business for tax purposes in the state of Missouri. This guide provides step-by-step instructions on how to complete the form effectively and efficiently.

Follow the steps to fill out the 2643A Missouri Tax Registration Application online.

- Click the ‘Get Form’ button to access the 2643A Missouri Tax Registration Application. This will allow you to open and edit the form online.

- Begin by entering your Missouri Tax I.D. Number in the designated field. If you have a Federal Employer I.D. Number (FEIN), please input it as well.

- Select all the tax types for which you are applying. Options include Retail Sales, Regular Withholding, and more. Mark the appropriate boxes clearly.

- Provide your business name and physical location. Ensure to fill in the street address (no P.O. Boxes), city, county, ZIP code, and state.

- Indicate whether sales will be made at various temporary locations in Missouri. If yes, attach a list of those locations.

- Specify if your business is located inside the city limits of any municipality in Missouri. If yes, identify the city.

- Answer questions regarding your business activities and types of products or services provided. Include details on sales percentages and specific activities.

- If applicable, fill out questions regarding out-of-state business activities. Provide necessary details and attach lists as required.

- Complete the ownership type section. This includes indicating whether you operate as a sole proprietor, partnership, corporation, or LLC.

- Provide information about the owner, including name, contact details, and Social Security Number if applicable.

- Complete previous owner information if your business is a continuation of a previous entity. List the items purchased from the prior owner.

- Fill in the mailing address for correspondence and specify which forms you wish to receive at this address.

- Enter the names and details of the officers, partners, or members who will oversee tax matters for your business.

- Provide estimated sales tax liability and attach any necessary bond information, ensuring that calculations comply with requirements.

- Review all entered information for accuracy and completeness. Address any missing sections as this may delay processing.

- Once completed, save your changes. You can download, print, or share the filled form for your records.

Complete your 2643A Missouri Tax Registration Application online today to ensure prompt processing!

A sales tax license can be obtained by registering through MyTaxMissouri or by mailing in Form 2643. Out-of-state businesses will register for a Missouri Vendor Use Tax License in addition to posting a bond. Information needed to register includes: Names, addresses, and SSN of owners/officers/members.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.