Loading

Get Form 8288

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8288 online

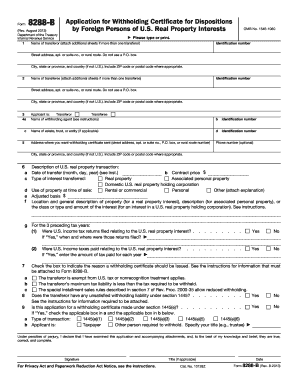

Form 8288 is essential for foreign persons applying for a withholding certificate for dispositions of U.S. real property interests. This guide will lead you through filling out the form online, ensuring you provide the necessary information accurately and efficiently.

Follow the steps to complete Form 8288 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin with Line 1, entering the name, street address, and identification number of the transferor. If there are multiple transferors, ensure to attach additional sheets with the required information for each.

- Proceed to Line 2, providing the name, street address, and identification number of the transferee. Similar to Line 1, include additional sheets if necessary.

- In Line 4a, indicate the name of the withholding agent, typically the buyer or transferee.

- For Line 4b, enter your social security number or ITIN if you are not applying in a personal capacity.

- Line 5 should include the address where you want the IRS to send the withholding certificate.

- Fill out Line 6, detailing the description of the U.S. real property transaction including contract price, date of transfer, and type of interest transferred.

- In Line 6g, specify whether U.S. income tax returns related to the U.S. real property interest were filed in the past three years.

- Complete Lines 7 and 8 to indicate the reason for requesting the withholding certificate and if there are any unsatisfied withholding liabilities.

- If applicable, continue to Line 9 to indicate if the application for a withholding certificate is being made under section 1445(e).

- Finally, sign the form, ensuring all fields are accurately filled before saving your changes, downloading, printing, or sharing the completed form.

Complete your Form 8288 online now to ensure a smooth application process.

Form 8288 is the transmittal for Form 8288-A. The buyer of a U.S. real property interest that is required to withhold FIRPTA tax must file both Form 8288 and Form 8288-A with the IRS within 20 days of the transfer of the property to report and remit the amount withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.