Loading

Get Nebraska And County Lodging Tax Return - Formupack

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska And County Lodging Tax Return - Formupack online

Filling out the Nebraska And County Lodging Tax Return - Formupack online can be a straightforward process when you follow the right steps. This guide is designed to help users navigate through each section of the form with clarity and confidence, ensuring that all necessary information is accurately provided.

Follow the steps to complete your lodging tax return online.

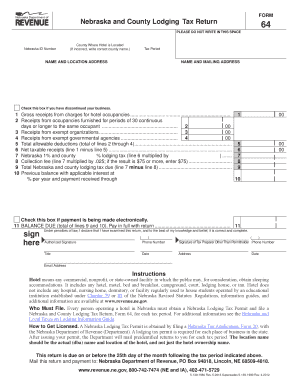

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your Nebraska ID number in the designated field. Make sure this number is accurate, as it helps identify your business for tax purposes.

- Indicate the county where your hotel is located. If the county listed is incorrect, clearly write the correct county name in the provided space.

- Select the tax period for which you are filing the return. Ensure that this matches your records.

- Fill in the name and address of your business. If you have discontinued your business, check the appropriate box.

- Report gross receipts from charges for hotel occupancies on line 1. This includes all earnings from lodging services provided.

- Record any receipts for exemptions on lines 2 through 4. Make sure to reflect the proper amounts and understand the exemptions applicable to your operations.

- Total the allowable deductions from lines 2 through 4 and enter this amount on line 5.

- Calculate your net taxable receipts by subtracting the total allowable deductions from the gross receipts, entering this figure on line 6.

- Multiply the net taxable receipts by the Nebraska lodging tax rate (1%) and any applicable county tax rate, and record this on line 7.

- Determine the collection fee based on line 7 multiplied by 0.025 (if this results in $75 or more, enter $75) and place this figure on line 8.

- Calculate the total lodging tax due by subtracting the collection fee on line 8 from the amount on line 7 and enter this result on line 9.

- If applicable, report any previous balance with interest on line 10.

- Calculate the total balance due by summing the amounts from lines 9 and 10, entering this on line 11.

- Provide the required signatures and contact information to finalize your form. Ensure that any tax preparer also signs.

- After completing the form, you can save your changes, download, print, or share the form as needed.

Start filling out your Nebraska And County Lodging Tax Return - Formupack online today to ensure timely filing.

Occupancy tax is a tax on the rental of rooms that the city, county, state or country may require; it is generally owed on the price of accommodations or any additional fees like cleanings or extra guests. An occupancy tax can also be referred to as a lodging tax, a room tax, a sales tax, a tourist tax, or a hotel tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.