Loading

Get Wv/nrae Application For Certificate Of Rev 4-08 Full Or ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV/NRAE APPLICATION FOR CERTIFICATE OF REV 4-08 online

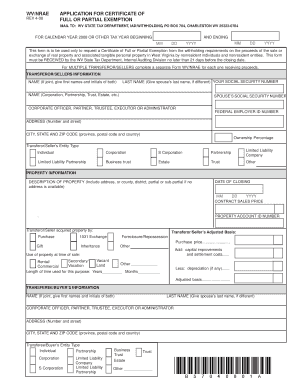

This guide provides a clear and detailed overview for filling out the WV/NRAE Application for Certificate of Full or Partial Exemption. Whether you are a first-time user or need a refresher, this step-by-step process will help ensure that your application is completed accurately and submitted on time.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the transferor/seller’s information. This includes the name, address, and identification numbers such as social security number or federal employer ID number. If applicable, provide details for both partners if they are filing jointly.

- Complete the property information section by providing a description of the property, including the address and any property account ID numbers. Also, enter the date of closing and the contract sales price.

- Identify how the transferor/seller acquired the property, indicating whether it was through purchase, 1031 exchange, gift, inheritance, or other means. Provide the adjusted basis of the property, including capital improvements and depreciation.

- Fill out the transferee/buyer’s information. Include their name and address, and indicate the entity type (individual, corporation, partnership, etc.).

- Select the reason for full or partial exemption from withholding. Check the relevant box and provide any required documentation to support the exemption request.

- Complete the calculation of tax to be withheld section if requesting partial exemption. Enter the amount subject to tax and the applicable tax rate.

- Provide signatures where required. Ensure that the application includes the signature of the transferor/seller and, if applicable, their spouse. Include a daytime phone number for contact purposes.

- Review the completed form for accuracy and make any necessary adjustments before finalizing.

- Save changes, download, print, or share the completed form as needed. Ensure that the application is mailed to the specified address no later than 21 days prior to the closing date.

Start filling out your WV/NRAE Application for Certificate of Full or Partial Exemption online now.

To apply for the sales tax exemption, organizations must submit a completed Certificate of Exemption to the West Virginia State Tax Department's Taxpayer Services Division.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.