Loading

Get Certificate Of Farming Use - Formupack

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of Farming Use - Formupack online

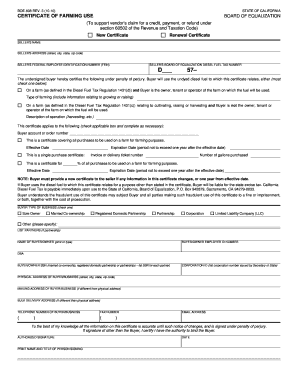

Filling out the Certificate Of Farming Use - Formupack online is a straightforward process that supports your claims for credit, payment, or refund under the California Revenue and Taxation Code. This guide will walk you through each section of the form, ensuring you provide the necessary information correctly.

Follow the steps to complete your form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select whether you are submitting a new certificate or a renewal certificate by checking the appropriate box.

- Enter the seller’s name and address, ensuring the details are accurate and complete.

- Provide the seller’s Federal Employee Identification Number (FEIN) and Board of Equalization Diesel Fuel Tax Number.

- In the buyer certification section, indicate how the diesel fuel will be used by checking the applicable box for either owning, leasing, or operating a farm.

- Fill out the type of farming or operation description, specifying if it relates to growing or raising.

- Indicate whether this certificate is for a single purchase or covers multiple purchases by checking the correct box.

- If applicable, enter the invoice or delivery ticket number and the number of gallons purchased.

- For users covering a percentage of all purchases, provide that percentage along with effective and expiration dates.

- Select the type of business that applies to the buyer from the options listed and fill in the required business identification details.

- Complete the contact details for the buyer, including physical and mailing addresses, telephone number, and email address.

- Final step: Review all information for accuracy before signing. After completing the form, save changes, download, print, or share the form as needed.

Take the next step and fill out your Certificate Of Farming Use - Formupack online today!

To apply for California tax exemption status, use form FTB 3500, Exemption Application. This is a long detailed form, much like the IRS form 1023. If you have already received your 501c3 status from the IRS, use form FTB 3500A, Submission of Exemption Request.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.