Loading

Get Ohio Beer And Malt Beverage Tax Return For Quali? Ed A-1c ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Beer And Malt Beverage Tax Return For Qualified A-1C online

This guide provides a clear and user-friendly approach to filling out the Ohio Beer And Malt Beverage Tax Return For Qualified A-1C online. Whether you are new to the process or need a refresher, these steps will help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

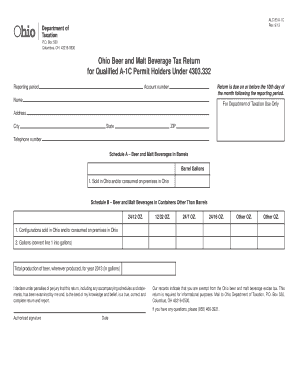

- Fill in the reporting period for which you are filing the return. Ensure that this corresponds with your business transactions during that timeframe.

- Enter your account number in the designated field, as this is essential for identifying your tax account.

- Complete the name field with your business’s registered name. This is important for tax purposes.

- Input your address details including city, state, and ZIP code. Accuracy is crucial to ensure proper communication and deliveries.

- Provide a telephone number where you can be contacted regarding your return.

- Move to Schedule A and list the quantity of beer and malt beverages sold in Ohio and consumed on premises. Report the amount in barrels.

- Proceed to Schedule B and fill in the configurations of beer and malt beverages in different container sizes. Include the number sold in Ohio and consumed on premises.

- Convert the line 1 results from Schedule B into gallons and report that information.

- Enter the total production of beer for the year 2013 in gallons, regardless of production location.

- Read and affirm the declaration statement, ensuring that the information provided is true, correct, and complete by signing and dating the return.

- Once all fields are completed, save your changes, download the form, and consider printing or sharing it as needed.

Complete your Ohio Beer And Malt Beverage Tax Return online today for accurate and timely submissions.

Ohio sales and use tax statutes presume that tax is owed on all sales/use of tangible personal property, which includes alcoholic beverages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.