Loading

Get Fill In M 941d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill In M 941d online

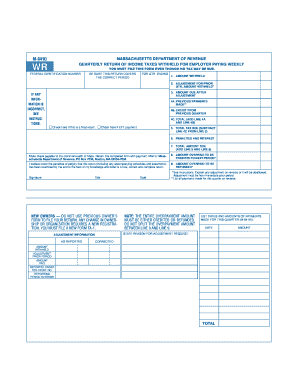

Filling out the Fill In M 941d form is an essential task for employers in Massachusetts to report income taxes withheld. This guide will walk you through the necessary steps to complete the form online, ensuring you provide accurate and timely information.

Follow the steps to successfully complete your Fill In M 941d form online.

- Click 'Get Form' button to access the Fill In M 941d form and open it for editing.

- Begin by entering your federal identification number at the top of the form. Ensure that this number is accurate as it uniquely identifies your business.

- Verify that the return covers the correct period for the quarter ending specified on the form.

- In section 1, input the total amount withheld for the specified quarter accurately.

- If applicable, adjust for any prior quarter amount withheld in section 2. Be sure to check the instructions if there are any discrepancies.

- Calculate the amount due after adjustment in section 3, considering the figures from sections 1 and 2.

- List any previous payments made in section 4A, and include any credit from the previous quarter in section 4B. Sum these values in section 4C.

- Determine the total tax due in section 5 by subtracting section 4C from section 3.

- Calculate any penalties and interest that may apply in section 6.

- Add the totals from section 5 and section 6 in section 7 to find the total amount due.

- Indicate if this is a final return or if an electronic funds transfer payment is being made.

- If applicable, fill out section 8 regarding any amount overpaid that will be credited to the next period.

- Complete section 9 if you are requesting a refund for any overpaid amounts.

- Sign and date the form, and complete the title field to certify the accuracy of the information provided.

- Once all fields are filled out, you can choose to save changes, download, print, or share the completed form as necessary.

Complete your Fill In M 941d form online today to ensure compliance and timely submission.

Related links form

As an employer, if you have not paid your employees any wages for the quarter, your tax amount will automatically be zero. Even if your tax amount is zero, the IRS expects you to file your Form 941. There is no need to waste your time entering zeros throughout your Form 941.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.