Loading

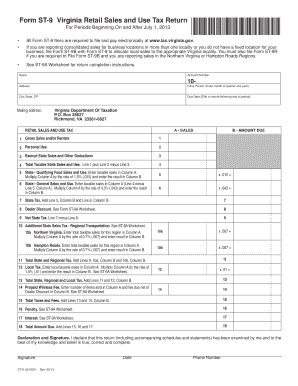

Get Form St-9 Virginia Retail Sales And Use Tax Return *vast09113888*

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-9 Virginia Retail Sales And Use Tax Return VAST09113888 online

Filing your Form ST-9 for Virginia's Retail Sales and Use Tax can be straightforward with the right guidance. This document outlines each component of the form and provides step-by-step instructions to ensure a smooth online filing process.

Follow the steps to accurately complete the Form ST-9 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name, account number, and address in the specified fields to clearly identify your business.

- Fill in the filing period by entering the month or quarter and year for which you are reporting taxes.

- Provide your city, state, and ZIP code for accurate identification of your business location.

- Record the due date, which is the 20th of the month following the end of your filing period.

- Complete Section A – Sales. Enter your gross sales and/or rentals on Line 1, including both cash and credit sales.

- Input any personal use sales on Line 2, detailing property removed from your inventory.

- Record exempt sales and other deductions on Line 3; ensure to classify any exempt sales correctly.

- Calculate total taxable state sales and use on Line 4 by adding Lines 1 and 2, then subtracting Line 3.

- For Lines 5 and 6, enter qualifying food sales and general sales respectively, applying the correct tax rates to compute amounts due.

- Add all applicable state and local taxes to calculate your total tax amount due on Line 13.

- Complete the declaration and signature section to confirm that the information is true and complete, including your phone number and the date.

- Finally, save your changes. You can download, print, or share the form for your records or for payment purposes.

Ensure to file your Form ST-9 online to meet legal requirements efficiently.

The type of tax: Business tax bills (choose Business Bill Payments) ... The bill number (if paying a bill) Your credit card information. The amount of the tax or fee payment. Your Social Security number or FEIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.