Loading

Get 2013 Form 8879-c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Form 8879-C online

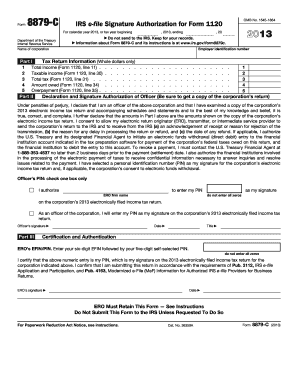

Filling out the 2013 Form 8879-C is an essential step for corporate officers who wish to electronically sign their corporation's income tax return. This guide provides clear and structured instructions to help you navigate the online process effectively.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Input the Employer Identification Number (EIN) and name of the corporation at the top of the form, following the on-screen prompts.

- In Part I, enter the total income, taxable income, total tax, amount owed, and overpayment as indicated on your corporation's 2013 income tax return. Ensure that all amounts are entered in whole dollars only.

- Move on to Part II, where the corporate officer must review the declaration. Check the relevant box to authorize the ERO to enter the officer's Personal Identification Number (PIN) or indicate that the officer will enter the PIN themselves.

- In the designated fields, the officer should then enter their signature, date, and title. This step is crucial for validating the form.

- Proceed to Part III, where the ERO will enter their EFIN and self-selected PIN. Ensure that the entry is accurate and complies with the required format.

- Review all entries for accuracy, and then save the completed form. Options to download, print, or share the form will be available for your convenience.

Complete your documents online with ease by following these steps!

To submit Form 8879, you need to ensure it is completed and signed. After signing, your tax professional will typically submit it electronically along with your tax return. If you are using uslegalforms, the platform can guide you through the submission process, ensuring you meet all IRS requirements efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.