Loading

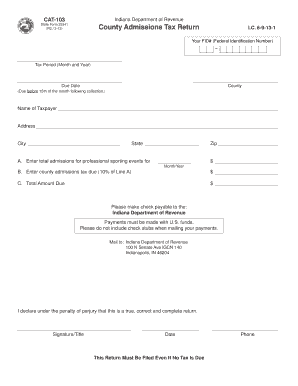

Get State Form 25341 County Admissions Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Form 25341 County Admissions Tax Return online

Filing the State Form 25341 County Admissions Tax Return online is an important process for reporting county admissions tax on professional sporting events. This guide provides a comprehensive overview and step-by-step instructions to help users navigate the form efficiently.

Follow the steps to complete your County Admissions Tax Return online.

- Press the ‘Get Form’ button to access the State Form 25341 County Admissions Tax Return and open it in an appropriate online editor.

- Enter your Federal Identification Number (FID#) in the designated space at the top of the form. This number is crucial for identifying your tax account.

- Fill in the tax period by indicating the month and year for which you are reporting the admissions tax in the specified field.

- Specify the due date for the return. Remember, this must be submitted before the 15th of the month following the collection period.

- Indicate the county for which you are filing. This information helps direct your payment to the correct local tax authority.

- Provide your name as the taxpayer in the field labeled 'Name of Taxpayer' to ensure the form is properly attributed.

- Enter your full address, including city, state, and zip code. This information is necessary for your tax records.

- In section A, report the total admissions for professional sporting events by entering the appropriate dollar amount and specify the month and year.

- In section B, calculate the county admissions tax due, which is 10% of the amount reported in Line A. Enter this amount in the designated space.

- Add the totals in section C by calculating the total amount due and record it in the provided field.

- Please note that payments must be made in U.S. funds, and checks should be payable to the Indiana Department of Revenue. Do not include check stubs with payments.

- After filling out the form, proceed to sign and date it. This signature confirms the accuracy of your return under the penalty of perjury.

- Finally, provide your contact phone number to ensure that you can be reached if there are any questions regarding your return.

- Once all information is complete, save your changes and download, print, or share the form as necessary.

Take the next step in filing your County Admissions Tax Return online today!

The minimum combined 2023 sales tax rate for Tacoma, Washington is 10.3%. This is the total of state, county and city sales tax rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.