Loading

Get Massachusetts Employee's Withholding Exemption Certificate Form M-4 - Cfa Harvard

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massachusetts Employee’s Withholding Exemption Certificate Form M-4 - Cfa Harvard online

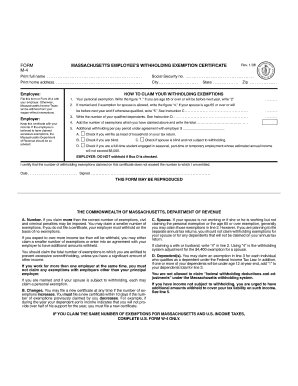

The Massachusetts Employee’s Withholding Exemption Certificate Form M-4 is an essential document that allows employees in Massachusetts to claim exemptions from state income tax withholding. This guide provides step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out your withholding exemption certificate.

- Click the ‘Get Form’ button to access the Massachusetts Employee’s Withholding Exemption Certificate Form M-4.

- Begin by entering your personal information. This includes your full name, Social Security number, and home address. Ensure that all information is accurate to avoid issues with processing.

- In the first section of the form, indicate your personal exemption. If you are not yet 65 years old, write '1'. If you will turn 65 before next year, write '2'.

- Next, determine your spouse's exemption if applicable. If married and your spouse qualifies for an exemption, write '4'. If they will be 65 or older, write '5'.

- Record the number of qualified dependents you have. If you have dependents under age 12 by the end of the year, you may add '1' to the total for this section.

- Add the numbers of exemptions claimed in the previous steps and write the total in the designated field.

- If you have an agreement with your employer for additional withholding, indicate the amount in the provided space.

- Review any additional options available, such as checking boxes for head of household or if you are blind. Make sure to read the specific conditions associated with each option.

- Certify the accuracy of the information provided by signing and dating the form. This is a crucial step for ensuring the validity of your claim.

- Once all fields are completed, save your changes, and prepare to download, print, or share the form as needed.

Complete your Massachusetts Employee's Withholding Exemption Certificate Form M-4 online today for accurate tax withholding!

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.