Loading

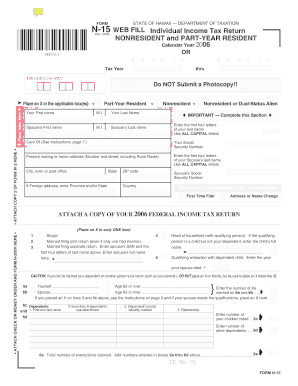

Get N-15 Rev 2006 Nonresident And Part-year Resident Income Tax Return. Forms 2006 Cd Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the N-15 Rev 2006 NonResident And Part-Year Resident Income Tax Return. Forms 2006 CD Fillable online

Filling out the N-15 Rev 2006 NonResident and Part-Year Resident Income Tax Return is an essential step for users who need to report income in Hawaii. This guide provides a clear, step-by-step approach to ensure accurate completion of the form.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Enter the tax year dates in MMDDYY format in the designated fields. For example, do not enter slashes; write it as 123106.

- Select the applicable status box for your residency: Nonresident or Part-Year Resident. Enter your personal information, including your name and social security number.

- Provide your current mailing address, including city, state, and ZIP code, ensuring all fields are filled accurately.

- Attach a copy of your 2006 federal income tax return if required. Mark the appropriate box indicating the filing status: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete the income section by entering the total income amounts accurately as instructed. This includes wages, interest income, dividends, and other sources of income.

- Proceed to the adjustments section where you can enter various deductions such as IRA deductions, moving expenses, and any applicable credits.

- Calculate your taxable income by following the formulas provided for each section, ensuring the figures are relevant to your specific situation.

- Review the tax owed section, mark if tax is calculated through a tax table, and ensure to add any nonrefundable tax credits you qualify for before calculating your final balance.

- Sign and date the form, and if it is a joint return, ensure both parties have signed. Provide additional details for any paid preparers if applicable.

- Once completed, save changes, download the finalized form, or print it for your records. Ensure to share it or mail it to the appropriate tax office if required.

Start filling out your N-15 Rev 2006 tax return online today to ensure your information is accurately reported.

If you are a nonresident or part-year resident of Wisconsin and your Wisconsin gross income (or the combined gross income of you and your spouse) is $2,000 or more, you must file a Form 1NPR, Nonresident and Part-Year Resident Income Tax Return. The Form 1NPR and instructions can be downloaded from our website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.