Loading

Get Form 560

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 560 online

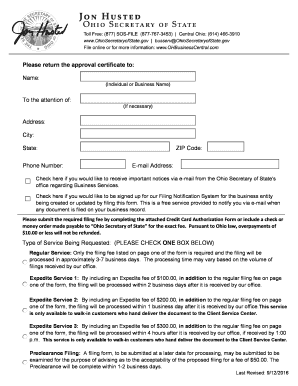

Filling out Form 560 online can simplify the process of submitting a certificate of dissolution for a nonprofit, domestic corporation. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out Form 560 online.

- Click the ‘Get Form’ button to access the digital version of Form 560. This allows you to open the document in an online format for completion.

- Begin by entering your corporation's name and charter number. This information is critical to identify your entity within the Ohio Secretary of State's records.

- Provide the location of your principal office in Ohio, including city, county, and any necessary addresses. Ensure this information is accurate to avoid processing delays.

- List the names and addresses of the corporation's directors and officers. This includes any individuals who hold an official position within the corporation.

- Designate a statutory agent by providing their name and address. If appointing a new agent, ensure they accept the appointment by signing the designated area.

- Select a date of dissolution. This date can either be the filing date or a future date that is within 90 days from the filing date, as per Ohio law.

- Detail the manner of adoption of the resolution of dissolution. Choose whether the resolution was adopted by directors or members and provide the necessary basis for this adoption.

- Sign and print your name in the appropriate areas. Ensure that the signature is from an authorized officer or representative, which is essential for the validity of the form.

- After completing all sections, check for accuracy. Save any changes made to the form, and choose to download, print, or share the completed document as needed.

Complete your Form 560 online today to ensure a smooth submission of your certificate of dissolution.

You can have a traditional 401(k) at your day job, and a Solo 401(k) for your small business. In this case, you can increase your retirement savings while reducing your tax bill for the year. You can contribute up to $58,000 to your Solo 401(k) in 2021, and another $58,000 to the 401(k) account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.