Loading

Get Form 2602 - Request To Rescind Principal Residence Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2602 - Request To Rescind Principal Residence Exemption online

This guide will provide you with comprehensive instructions on how to fill out the Form 2602, which is used to rescind your principal residence exemption. Completing this form accurately is crucial for proper handling by local authorities.

Follow the steps to complete Form 2602 online.

- Press the ‘Get Form’ button to access the form and begin filling it out.

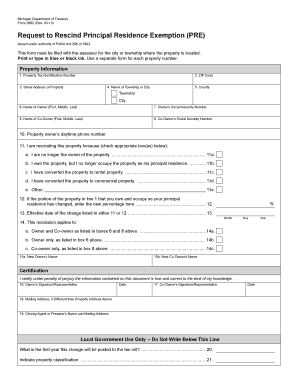

- Enter the property tax identification number in the space provided. This number can be found on your tax bill or property tax assessment notice. It is essential for accurate processing.

- Provide the complete ZIP code, street address, and specify the name of the township or city where the property is located.

- Indicate the county where the property is situated.

- Fill in the owner's full name (first, middle, last) and social security number. If there is a co-owner, provide their full name and social security number as well.

- Enter the daytime phone number of the property owner for contact purposes.

- Select the reason(s) for rescinding the exemption by checking the appropriate box or boxes that apply to your situation.

- If the ownership or occupancy has changed, specify the new percentage that you occupy as your principal residence, if applicable.

- Provide the effective date for the changes indicated in the previous sections.

- Indicate whether the rescission applies to the owner, co-owner, or both by selecting the appropriate box.

- If there has been a change in ownership, list the new owner's name and co-owner's name if applicable.

- Sign and date the form to certify that the information provided is correct to the best of your knowledge.

- If necessary, enter a different mailing address from the property address.

- Save your changes, and choose to download, print, or share the completed form as needed.

Complete your Form 2602 online to ensure your principal residence exemption is accurately processed.

A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills. ... The PRE is a separate program from the Homestead Property Tax Credit, which is filed annually with your Michigan Individual Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.