Loading

Get Form 10-d (eps) (supplied Free Of Cost At Epfo Offices/can Also ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 10-D (EPS) online

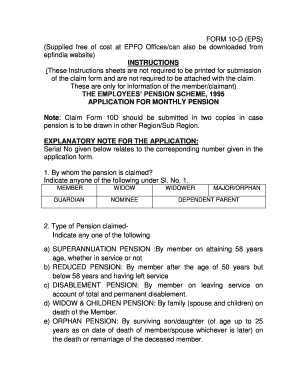

FORM 10-D is a vital document for individuals applying for a monthly pension under the Employees’ Pension Scheme, 1995. This guide will help you navigate through the process of filling out the form accurately and efficiently, ensuring that all necessary details are submitted correctly.

Follow the steps to fill out the FORM 10-D (EPS) efficiently.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Identify the claimant type in Section 1, marking any of the options such as member, widow, guardian, nominee, or dependent parent.

- In Section 2, specify the type of pension you are claiming by selecting one option from the list provided, including superannuation, reduced, disablement, or family pensions.

- Section 3 requires personal details of the member, including their name in block letters, marital status, date of birth in `dd/mm/yyyy` format, and parental names.

- Fill in Section 4 with the EPF account number, ensuring it contains the correct region and office codes along with the account number.

- Provide details of the establishment in Section 5 where the member was last employed.

- In Section 6, mention the date of leaving service. If applicable, indicate whether the member is still in service.

- If applicable, provide information about temporary and permanent addresses in Section 8.

- Indicate the desired pension start date in Section 8A if applicable.

- Sections 9, 10, and 11 are for pension scheme members only; follow the form instructions carefully if you fit this criteria.

- Complete Section 12 with the details of the surviving family members if the member is deceased.

- If applicable, attach the death certificate in Section 13.

- Fill in Section 14 with bank account details for pension disbursement, ensuring the accounts are set up in the designated bank.

- List past employment details in Section 15 and any existing pension details in Section 16.

- In Section 17, list required documents to be attached with the form such as photographs and any necessary certificates.

- After completing all sections, save your changes, and download or print the form to submit it as required.

Complete your FORM 10-D (EPS) online today for a smooth pension application process!

In case the widow/widower is receiving the EPS amount, they will continue to receive the amount until his/her death. After that, the children will receive the pension amount until they attain the age of 25 years. In case the child is physically challenged, they will receive the pension amount until his/her death.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.