Loading

Get Form 8825

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8825 online

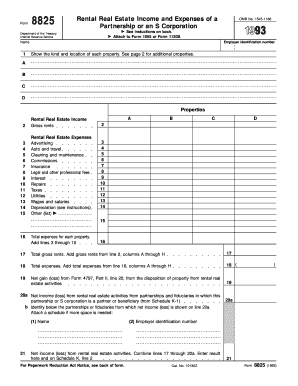

Filling out Form 8825 is essential for partnerships and S corporations to report their rental real estate income and expenses. This guide will help you navigate the form with ease, ensuring that you accurately provide the necessary information.

Follow the steps to complete Form 8825 online effectively.

- Click ‘Get Form’ button to access the form online and open it for editing.

- Begin by entering the name and employer identification number at the top of the form.

- In section 1, detail the kind and location of each property. This includes the property type (e.g., apartment building) and its address.

- Move to section 2 and report gross rental income in the designated fields for each property.

- Proceed to section 3, where you will enter the rental real estate expenses. Fill in all relevant categories such as advertising, cleaning and maintenance, insurance, and others listed.

- Once all income and expenses are entered, calculate and input total expenses for each property in line 16.

- For gross rents, total the amounts from line 2 for all properties and enter this on line 17.

- Sum the total expenses from line 16 onto line 18.

- Complete line 19 with the net gain (loss) from property dispositions related to rental activities.

- If applicable, report net income (loss) from partnerships or fiduciaries on line 20.

- Finally, combine the totals from lines 17 through 20a for the net income (loss) and enter this result on line 21.

- After entering all the required information, save your changes. You can download, print, or share the form as needed.

Complete your Form 8825 online today to ensure accurate reporting of rental income and expenses.

To complete a Form 8825, you will need to provide the following information: Name. Employer identification number. Type and address of each property. ... Rental real estate income. Rental real estate expenses. Total gross rents. Total expenses. Net gain from the deposition of property from rental real estate activities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.