Loading

Get Heloc Application - Riverhills Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HELOC Application - RiverHills Bank online

Completing the HELOC application at RiverHills Bank online can seem daunting, but with this comprehensive guide, you will be able to navigate each section with ease. This step-by-step approach ensures you provide all necessary information for a smooth application process.

Follow the steps to successfully complete the application.

- Press the ‘Get Form’ button to access the HELOC application form and open it in your preferred format.

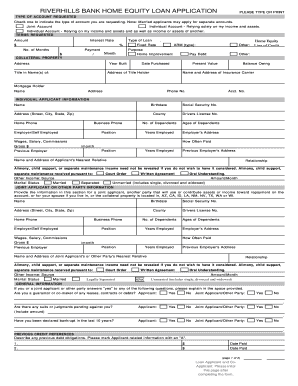

- Begin by selecting the type of account requested. Indicate whether you are applying for a joint account or an individual account, and specify if your application relies solely on your income or includes another party's income and assets.

- Fill in the terms requested by entering the amount of the loan, desired interest rate, and the number of months for repayment. This section provides essential details about what you are requesting.

- Provide information about the collateral property including the property address, year built, and title holder's name. Specify the intended purpose of the loan, such as home improvement or debt consolidation.

- Complete the individual applicant information section by entering your name, birthdate, social security number, county, driver's license number, and contact information including phone numbers. Include information about dependents and employment history.

- If applicable, complete the joint applicant or other party information section. Provide similar details as for the individual applicant for anyone contributing to the application, including their financial information.

- Answer the general information questions provided. This section helps assess any potential complications in your financial background. Include explanations where necessary.

- List your previous credit references by noting any past debts and their respective status. This helps in evaluating your creditworthiness.

- Detail your current assets and debts. Be thorough in describing account types, values, and outstanding balances. This comprehensive listing assists in assessing your financial health.

- Finalize the application by reviewing all inputted information for accuracy. After ensuring everything is correct, follow the final instructions to submit your application, which may include saving, downloading, printing, or sharing the form.

Start filling out your HELOC application online to secure your home equity loan today!

Your credit score is one of the key factors lenders consider when deciding if you qualify for a home equity loan or HELOC. A FICO® Score of at least 680 is typically required to qualify for a home equity loan or HELOC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.