Loading

Get Transient Tax Form - City Of Staunton, Va

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transient Tax Form - City Of Staunton, VA online

Filling out the Transient Tax Form for the City of Staunton, Virginia, can seem daunting, but this guide will help you navigate each section with ease. With clear step-by-step instructions, you will be able to complete the form accurately and efficiently, ensuring compliance with local tax regulations.

Follow the steps to complete the form smoothly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

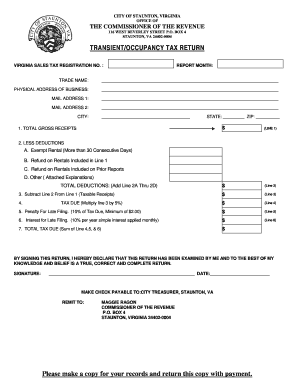

- Enter your Virginia sales tax registration number in the designated field at the top of the form.

- Indicate the report month for which you are filing the tax return.

- Fill in the trade name of your business as it appears on your registration documents.

- Provide the physical address of your business in the appropriate section on the form.

- List your mailing address, including both address lines if necessary, and ensure the city, state, and ZIP code are entered correctly.

- Complete Line 1 by entering your total gross receipts for the reporting month.

- For Line 2, provide the total deductions from your gross receipts, including exempt rentals and any refunds on rentals.

- Subtract Line 2 from Line 1 to find your taxable receipts, and enter this amount in Line 3.

- Calculate the tax due by multiplying the taxable receipts from Line 3 by 5% and enter it on Line 4.

- If applicable, calculate any penalties for late filing and interest on Line 5 and Line 6 respectively.

- Add Lines 4, 5, and 6 together to determine the total tax due and enter that total on Line 7.

- Sign and date the form to confirm the accuracy of the information provided.

- Make a copy of the completed form for your records before submission.

- Submit your payment along with the completed form to the City Treasurer, Staunton, VA.

Complete the Transient Tax Form online to ensure timely and accurate filing.

When assessing vehicles, we use the January National J.D. Power guide. When available, we use the clean trade value from this book. When that figure cannot be obtained, we then use a percent of the cost. The City's personal property tax rate is $2.90 per $100 of the assessed value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.