Loading

Get Dte Form 100 - Lake County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DTE FORM 100 - Lake County online

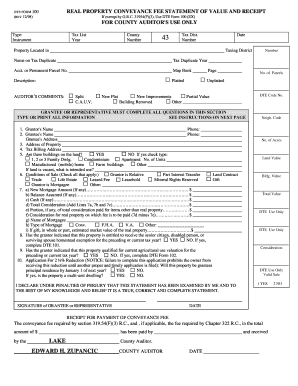

This guide provides clear, professional instructions on how to fill out the DTE FORM 100 for property conveyance in Lake County. Whether you are a first-time user or someone looking for a refresher, these step-by-step instructions will assist you in completing the form accurately online.

Follow the steps to successfully complete the DTE FORM 100.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin filling out the form by entering the grantor's name as it appears in the deed. Ensure the information is accurate.

- Next, provide the grantee's name and mailing address. This information must match the details in the conveying document.

- Enter the property address, including the street number and street name for the property being conveyed.

- Specify the tax billing address, which is the address where tax bills will be sent. Remember, each property owner needs to pay their property taxes on time.

- Indicate whether there are buildings on the land by selecting 'YES' or 'NO.' If there are buildings, select the appropriate type from the provided options.

- Complete the section regarding conditions of sale by checking all applicable boxes that apply to the transaction.

- In lines 7a through 7i, detail the financial components of the transaction, including new mortgage amount, cash paid, and total consideration. Ensure to calculate totals as specified.

- Answer questions regarding potential exemptions for senior citizens or disabled persons as applicable to the property being conveyed.

- For properties used as principal residences, complete the application for a tax reduction to ensure timely reflection of any benefits.

- Finally, review the form for accuracy, sign, and date it where indicated. Then, you have options to save changes, download, print, or share the completed form.

Complete your DTE FORM 100 online today to ensure a smooth property conveyance process.

There are exemptions to paying this tax. The tax does not apply to property ownership transfers from one spouse to another or to children and their spouses. The tax also does not apply if the ownership is transferred to a non-profit agency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.