Loading

Get Cpe Catch-up Form - Alabama State Board Of Public Accountancy - Asbpa Alabama

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CPE Catch-Up Form - Alabama State Board Of Public Accountancy - Asbpa Alabama online

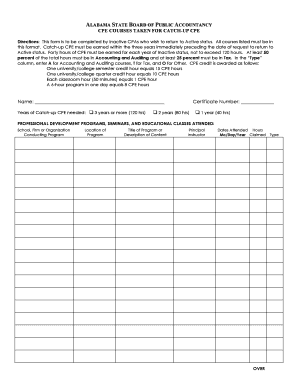

Filling out the CPE Catch-Up Form is an important step for inactive CPAs who wish to return to active status. This guide provides a detailed walkthrough of the form's components and offers clear instructions to ensure that users can effectively complete the form online.

Follow the steps to accurately complete the CPE Catch-Up Form.

- Press the ‘Get Form’ button to acquire the form and open it in your chosen editing tool.

- Begin by entering your name and certificate number at the top of the form. These fields are essential for identifying your record with the Alabama State Board of Public Accountancy.

- Indicate the years of catch-up Continuing Professional Education (CPE) needed. Choose from options for 3 years or more (120 hours), 2 years (80 hours), or 1 year (40 hours). Be sure to review your inactive status duration before completing this section.

- In the section labeled 'Professional Development Programs, Seminars, and Educational Classes Attended', list the programs you have completed. Provide details under the following columns: school or organization conducting the program, location of program, title of program or description of content, principal instructor, dates attended, hours claimed, and type (A, T, O).

- Continue to the next part for 'Correspondence or Individual Study Programs'. Here, report any self-study programs attended, including the school or organization providing the program, program title or description, date completed, hours claimed, and type.

- Utilize the section for 'Speaker, Discussion Leader or Instructor' to document CPE hours earned if you conducted or presented at a program. Complete the required fields for program title, sponsor of the program, location, description, date, hours claimed, and type.

- In the summary section, appropriately allocate your total CPE hours earned into the categories of Accounting and Auditing, Tax, and Other. Calculate the grand total of hours and enter that figure.

- Finally, provide your signature and date at the bottom of the form to validate your submission. Review the completed form for accuracy before finalizing.

- Once all sections are filled and confirmed, save your changes, and proceed to download, print, or share the form as needed.

Complete your CPE Catch-Up Form online today and take the next step towards returning to active status.

With the standard bachelor's degree in accounting consisting of 120 semester hours, going on to earn a master's in accounting or post-baccalaureate certificate is the most tried and tested way to get those 30 additional credits you need to become a CPA in Alabama. Many of these programs are available entirely online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.