Loading

Get City Of Stanford Net Profit License Fee Return (please Attach A Copy ... - Stanfordky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City of Stanford Net Profit License Fee Return online

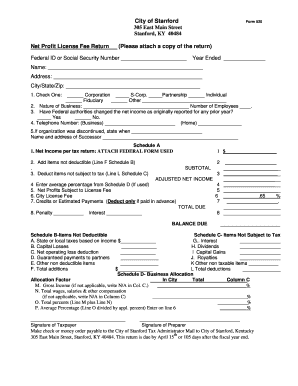

This guide provides a comprehensive overview of how to complete the City of Stanford Net Profit License Fee Return. It is designed for individuals and businesses filing their license fee returns, ensuring a clear understanding of each component and facilitating a smooth online submission process.

Follow the steps to complete your Net Profit License Fee Return efficiently.

- Click ‘Get Form’ button to access the City of Stanford Net Profit License Fee Return form and open it in your preferred editing tool.

- Carefully fill in your Federal ID or Social Security Number in the designated space. This will help identify your tax account.

- Indicate the year ended for which you are filing the return.

- Provide your name, business address, and city/state/zip code in the appropriate fields.

- Select the type of business entity by marking the box that corresponds to your structure (Corporation, S-Corp, Partnership, Individual, Fiduciary, or Other).

- State the nature of your business and the number of employees working for you.

- Answer whether federal authorities have made any adjustments to your net income for any previous years.

- Enter your business and home telephone numbers.

- If your organization has been discontinued, provide the discontinuation date and the name and address of the successor.

- In Schedule A, attach the federal tax return form used and enter the net income as indicated.

- Add any items that are not deductible to the net income and subtract the deductions not subject to tax.

- Next, calculate the adjusted net income and record the average percentage if Schedule D was utilized.

- Determine the net profits subject to the license fee and calculate the corresponding city license fee.

- Enter any credits or estimated payments, deducting only those that were paid in advance.

- Finally, summarize the total due, including any penalties or interest applicable.

- Sign the form, and if applicable, have your preparer sign as well.

- Make a payment via check or money order payable to the City of Stanford Tax Administrator and mail your completed return to the given address by the due date.

Start filling out your City of Stanford Net Profit License Fee Return online today for a hassle-free experience!

The City of Mayfield Net Profit License Fee is levied at the annual rate of 2% the first $50,000.00, plus 1% of $50,000 thru $500,000 and ½ % over $500,000 with a minimum of $100.00 of the net profits of all occupations, trades, professions or other businesses engaged in said activities in the City.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.