Loading

Get Loan Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Request Form online

Filling out the Loan Request Form online can be a straightforward process when you understand each section of the form. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the Loan Request Form.

- Click 'Get Form' button to obtain the form and open it in the editor.

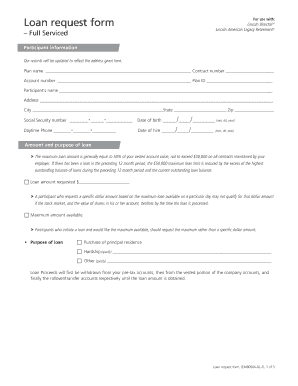

- Fill in participant information. Start with the plan name and the provided contract and account numbers. Ensure that the participant's name, address, city, state, and zip code are accurately entered.

- Specify the amount and purpose of the loan. Indicate either the amount requested or choose to request the maximum amount available, then select the reason for the loan from the given options.

- Complete the loan repayment section. Choose the duration of the loan, and enter the interest rate and the date for the first payment. Select the repayment frequency that suits your needs.

- Choose your payment instructions for how you wish to receive the loan proceeds. Fill in your bank routing number, account number, and specify if it is checking or savings.

- If applicable, obtain necessary signatures. Ensure the participant and spouse sign where required, including the witness signature, if relevant.

- Review the completed form for accuracy. Make sure all required fields are completed and all signatures are obtained before submission.

- Once you are satisfied with the form, you can save the changes, download, print, or share the completed form as needed.

Begin filling out your Loan Request Form online today for a smooth and efficient loan application process.

Related links form

If your parents won't co-sign a private student loan, you can ask another relative or a trusted friend to sign the loan documents. Eligibility requirements vary depending on the lender and the loan you want to take out, but generally the co-signer will need income and a good credit score to qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.