Loading

Get Cotst 919 - Comptroller Of Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the COTST 919 - Comptroller Of Maryland online

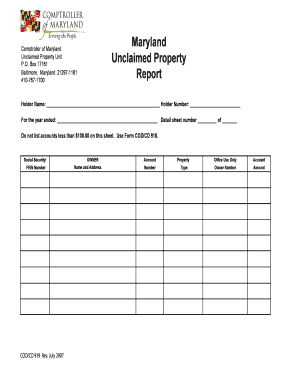

Filling out the COTST 919 form for unclaimed property in Maryland can seem daunting, but this guide provides straightforward instructions to help you navigate the process. By following these steps, you will be able to efficiently complete the form and report any unclaimed property accurately.

Follow the steps to complete your form successfully.

- Press the ‘Get Form’ button to access the COTST 919 form and open it for editing.

- Begin by entering your holder name in the designated field. This is your organization or business name responsible for the unclaimed property.

- Next, provide your holder number, which is a unique identifier assigned to your entity by the Maryland Comptroller's office.

- Indicate the reporting year by filling in the appropriate field for the year ended. Ensure that this reflects the correct accounting period for your unclaimed property report.

- Fill in the detail sheet number as well as the total number of detail sheets you are submitting with this form. This helps in organizing multiple entries.

- Make sure to only list accounts with values of $100.00 or more on this form. If you have accounts less than this amount, use Form COD/CD 918 instead.

- Input the Social Security or FEIN number that corresponds to your entity. This is essential for identification purposes.

- Complete the owner section by entering the name and address of the property owner, ensuring that all details are accurate.

- List each account, including the account number and the type of property. Additionally, state the amount associated with each account.

- After you have filled out all sections and verified the information for correctness, you can save your changes, download, print, or share the form as needed.

Complete your COTST 919 form online today for efficient unclaimed property reporting.

The comptroller audits taxpayers for compliance, handles delinquent tax collection, and enforces license and unclaimed property laws. ... Acting as Maryland's chief accountant, the comptroller pays the state's bills, maintains its books, prepares financial reports, and pays state employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.