Loading

Get In Kerala Commercial Taxes How Does Enter In Reverse Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the In Kerala Commercial Taxes How Does Enter In Reverse Tax Form online

This guide provides detailed instructions for completing the In Kerala Commercial Taxes How Does Enter In Reverse Tax Form online. Whether you are a new user or have previous experience, this comprehensive approach will support you in accurately filling out the necessary fields.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

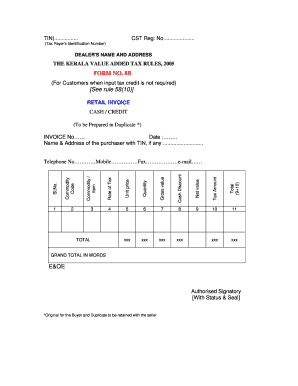

- Begin by entering the Taxpayer's Identification Number (TIN) at the designated field to identify your business correctly.

- Fill out the CST Registration Number which can be found in your GST registration documents.

- Enter the dealer's name and complete address to ensure proper identification.

- Specify the invoice type (cash or credit) and provide the invoice number along with the date of the transaction.

- List the purchaser’s name, address, and TIN if available, ensuring to collect accurate information.

- In the appropriate sections, input the individual commodity or item details, including the quantity, unit price, and the rate of tax applicable.

- Calculate the gross value before any discounts, and then note any cash discounts that apply.

- Derive the net value after deducting the cash discount and add the applicable tax amount to achieve the total.

- Ensure all requested contact information is filled out, including telephone number, mobile number, fax number, and email address.

- Verify the grand total and write it in words for clarity, alongside capturing the authorisation by including the signatory's name, status, and seal.

- Once all sections are filled accurately, save changes, download a copy of the completed form, and share or print as needed.

Start completing your documents online today for a seamless experience.

Kerala VAT E-Filing Those dealers operating or based out of Kerala are required by law to file periodic VAT returns and also an annual VAT return. Filing of VAT returns can be done electronically and is applicable for those dealers who have had a payable VAT of more than Rs 10 Lakhs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.